Whole life insurance is a type of permanent life insurance that offers a death benefit and a cash value component. The cash value component grows over time, potentially providing a source of funds for various financial needs. A whole life insurance cash value chart helps policyholders visualize how their cash value is expected to accumulate over the life of the policy.

This chart is a powerful tool for understanding the potential growth of your investment, as well as the factors that can impact its trajectory. By examining the chart, you can gain valuable insights into the long-term benefits of whole life insurance and how it can be incorporated into your overall financial planning strategy.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay your premiums. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection.

Whole life insurance is designed to provide financial security for your loved ones after your passing. It also offers a cash value component that grows over time, providing you with a source of savings and potential investment opportunities.

Key Features of Whole Life Insurance

Whole life insurance policies have several key features that distinguish them from other types of life insurance. These features include:

- Lifelong Coverage: Whole life insurance provides coverage for your entire life, as long as you continue to pay your premiums. This offers peace of mind knowing your loved ones will be financially protected regardless of when you pass away.

- Cash Value Accumulation: A portion of your premium payments goes towards building a cash value account. This cash value grows over time, earning interest and potentially increasing in value. You can borrow against your cash value or withdraw it, subject to certain conditions and fees.

- Fixed Premiums: Whole life insurance premiums remain fixed for the life of the policy. This means you know exactly how much you will be paying each month, providing budget predictability.

- Guaranteed Death Benefit: Whole life insurance policies guarantee a specific death benefit payout to your beneficiaries upon your passing. This ensures your loved ones receive a predetermined amount, providing financial security during a difficult time.

Differences Between Whole Life and Term Life Insurance

Whole life insurance and term life insurance are two distinct types of life insurance, each with its own advantages and disadvantages. Understanding the key differences can help you choose the right policy for your needs.

| Feature | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage Period | Lifelong | Specific term (e.g., 10, 20, 30 years) |

| Premiums | Fixed | Typically lower, but increase as you age |

| Cash Value | Accumulates | No cash value |

| Death Benefit | Guaranteed | Only paid if you pass away during the term |

Choosing between whole life and term life insurance depends on your individual needs and financial situation. Term life insurance is generally more affordable and suitable for short-term needs, such as covering a mortgage or providing income replacement for a limited time. Whole life insurance, with its lifelong coverage and cash value component, can be a better option for those seeking long-term financial security and investment opportunities.

Understanding Cash Value in Whole Life Insurance

Whole life insurance offers a unique feature: cash value accumulation. This component acts as a savings account within your policy, growing over time. Understanding how this cash value works is crucial for maximizing the benefits of whole life insurance.

Cash Value Accumulation

Cash value accumulates through premiums paid beyond the cost of death benefit coverage. A portion of each premium goes towards the death benefit, while the remaining portion is allocated to the cash value account. This account earns interest, typically at a guaranteed rate, which contributes to its growth.

Cash value accumulation is like a savings account within your whole life insurance policy.

Factors Influencing Cash Value Growth

Several factors impact the growth of cash value in whole life insurance:

- Interest Rates: The interest rate credited to your cash value account directly influences its growth. Higher interest rates lead to faster accumulation.

- Premiums: The amount of premium paid beyond the cost of death benefit coverage directly contributes to the cash value. Higher premiums result in greater cash value growth.

- Policy Fees and Expenses: These costs are deducted from premiums before they are allocated to cash value. Lower fees and expenses lead to greater cash value accumulation.

- Investment Performance: In some cases, whole life insurance policies offer investment options, where a portion of your premiums is invested in various assets. The performance of these investments can influence cash value growth.

Accessing Cash Value

You can access your cash value in various ways:

- Policy Loans: You can borrow against your cash value at a fixed interest rate. This can be helpful for covering unexpected expenses or funding financial goals.

- Partial Withdrawals: You can withdraw a portion of your cash value, typically with a surrender charge. This can be useful for short-term needs or emergencies.

- Surrender the Policy: You can surrender the policy and receive the accumulated cash value, but this will terminate the death benefit coverage.

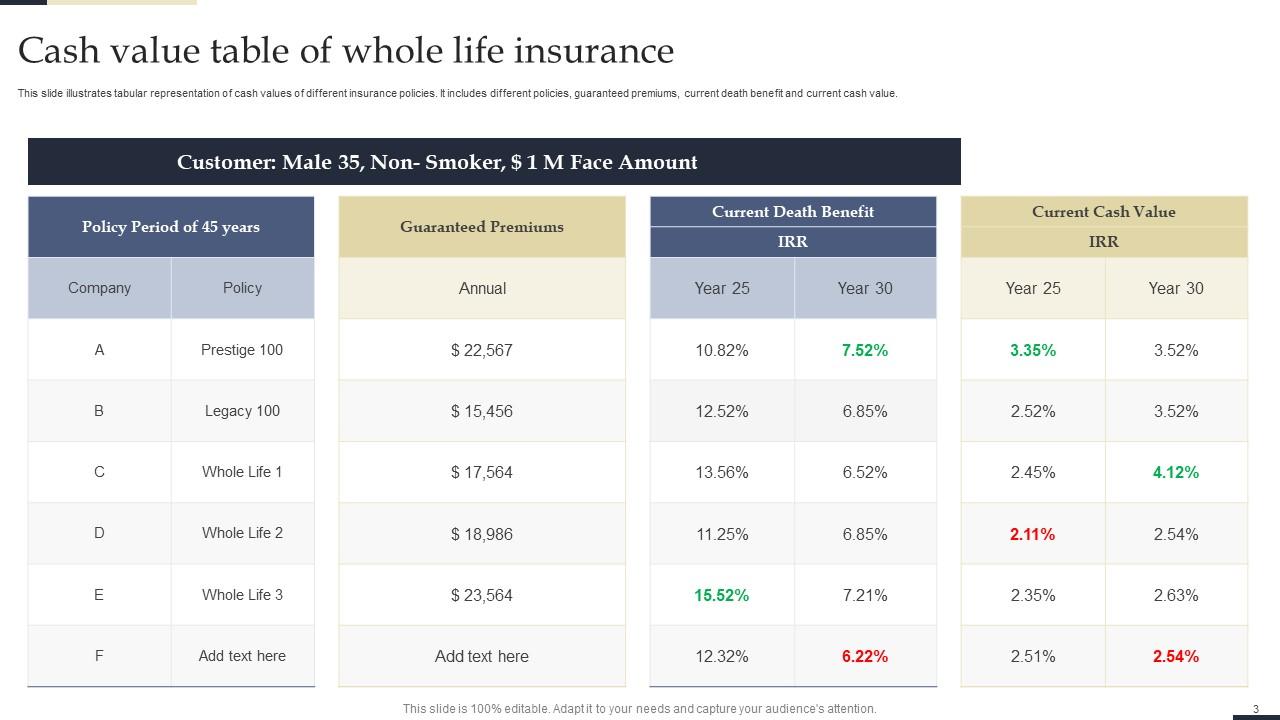

How to Read a Whole Life Insurance Cash Value Chart

A whole life insurance cash value chart is a valuable tool for understanding the growth of your policy’s cash value over time. By analyzing the chart, you can gain insights into the potential returns, the impact of premiums, and the overall performance of your policy.

Understanding the Structure of a Whole Life Insurance Cash Value Chart

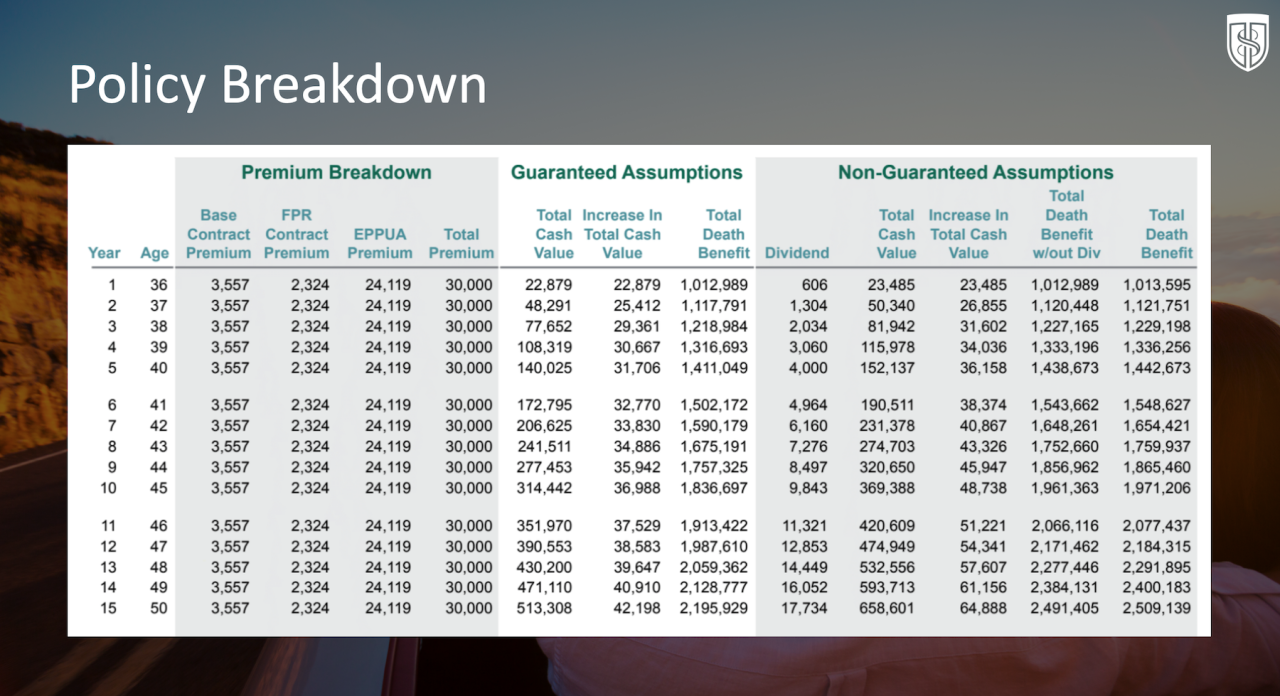

A typical whole life insurance cash value chart will present information in a tabular format, typically with columns representing key aspects of the policy. The columns usually include:

- Policy Year: This column represents the number of years the policy has been in effect.

- Premium Paid: This column indicates the total amount of premiums paid into the policy up to that year.

- Cash Value: This column shows the accumulated cash value of the policy at the end of each year.

- Death Benefit: This column displays the amount of death benefit payable to the beneficiary if the policyholder passes away during that year.

Interpreting the Data on a Whole Life Insurance Cash Value Chart

The data on a whole life insurance cash value chart can be interpreted in several ways to gain a comprehensive understanding of your policy’s performance.

- Cash Value Growth: Observe how the cash value grows over time. The growth pattern can vary depending on the policy’s terms and the insurer’s investment performance.

- Premium vs. Cash Value: Compare the amount of premiums paid to the accumulated cash value. This helps determine the policy’s return on investment.

- Death Benefit Coverage: Assess how the death benefit changes over time. It typically remains fixed or increases slightly, providing a guaranteed level of coverage for your beneficiaries.

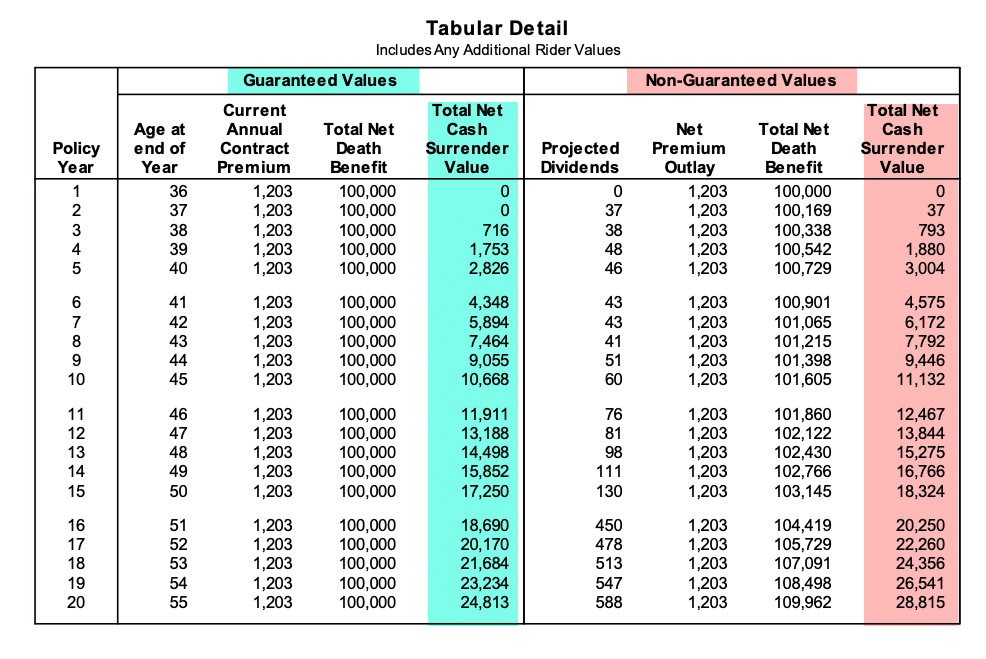

Example of a Whole Life Insurance Cash Value Chart

Consider a hypothetical whole life insurance policy with an initial death benefit of $100,000 and an annual premium of $1,000. The following table illustrates a simplified example of how the cash value might grow over the first five years:

| Policy Year | Premium Paid | Cash Value | Death Benefit |

|---|---|---|---|

| 1 | $1,000 | $50 | $100,000 |

| 2 | $2,000 | $120 | $100,000 |

| 3 | $3,000 | $200 | $100,000 |

| 4 | $4,000 | $300 | $100,000 |

| 5 | $5,000 | $420 | $100,000 |

Note: This is a simplified example for illustrative purposes only. Actual cash value growth and death benefit amounts may vary depending on the specific policy terms, insurer, and investment performance.

Factors Affecting Cash Value Growth

Cash value growth is a crucial aspect of whole life insurance, as it represents the savings component of the policy. Understanding the factors that influence cash value accumulation is essential for policyholders to make informed decisions.

Several key factors contribute to the growth of cash value.

Interest Rates

The interest rate credited to the cash value account plays a significant role in its growth. Higher interest rates lead to faster accumulation of cash value.

Cash value growth is directly proportional to the interest rate credited to the account.

For example, consider two whole life insurance policies with identical premiums and death benefits. If Policy A earns a 4% interest rate on its cash value and Policy B earns a 5% interest rate, Policy B’s cash value will grow faster than Policy A’s.

Policy Fees and Expenses

Policy fees and expenses, such as administrative costs, mortality charges, and premium taxes, can impact cash value growth. These charges are deducted from the premiums before the remaining amount is credited to the cash value account.

Higher fees and expenses result in slower cash value growth.

For instance, if Policy A has annual fees of $100 and Policy B has annual fees of $200, assuming all other factors are equal, Policy A’s cash value will grow faster than Policy B’s.

Cash Value Growth Over Time

Cash value growth is a key aspect of whole life insurance, offering a potential for long-term financial benefits. Understanding how cash value accumulates over time can help you make informed decisions about your financial planning.

Projected Cash Value Growth

The projected cash value growth for a specific policy can be illustrated through a table. This table shows the estimated cash value accumulation over a 20-year period for a hypothetical whole life insurance policy with a death benefit of $100,000 and an annual premium of $2,000.

| Year | Cash Value |

|---|---|

| 1 | $1,000 |

| 5 | $5,500 |

| 10 | $15,000 |

| 15 | $28,000 |

| 20 | $45,000 |

It is important to note that this is a hypothetical example and actual cash value growth may vary depending on factors such as the policy’s terms, interest rates, and the insurer’s investment performance.

Cash Value Growth and Inflation

Cash value growth has the potential to outpace inflation. Inflation erodes the purchasing power of money over time, but the cash value of a whole life insurance policy can grow at a rate that exceeds inflation. This can help preserve your savings and maintain their real value.

For example, if inflation averages 3% per year, a $100,000 investment would be worth approximately $180,611 after 20 years. However, if the cash value of a whole life insurance policy grows at an average rate of 5% per year, it would be worth approximately $265,330 after 20 years. This demonstrates how cash value growth can help offset the impact of inflation and preserve your financial security.

Long-Term Benefits of Cash Value Accumulation

Cash value accumulation can provide long-term financial benefits, including:

- Financial Security: Cash value can serve as a source of emergency funds or a safety net during unexpected financial challenges.

- Retirement Planning: Cash value can be accessed during retirement, providing supplemental income or supplementing other retirement savings.

- Estate Planning: Cash value can be used to cover estate taxes or other expenses related to estate planning.

- Tax Advantages: Cash value growth is generally tax-deferred, meaning you won’t have to pay taxes on the gains until you withdraw the funds.

Cash value accumulation offers a valuable tool for long-term financial planning. It can help you build wealth, protect your financial security, and achieve your financial goals.

Using Cash Value for Financial Planning

Whole life insurance offers a unique feature that can be a valuable asset for financial planning: cash value. This accumulating fund, built over time through premiums and investment earnings, can be accessed for various financial needs, providing flexibility and potential financial security.

Accessing Cash Value for Financial Planning

The cash value component of whole life insurance can serve as a source of funds for various financial goals.

- Emergency Fund: Cash value can act as a readily accessible emergency fund for unexpected expenses like medical bills, home repairs, or job loss. It provides a safety net without having to liquidate other assets.

- Education Expenses: The accumulated cash value can be used to cover college tuition, room and board, or other education-related expenses. This can be particularly beneficial for parents seeking to secure their children’s future.

- Retirement Income: While not typically the primary source of retirement income, cash value can supplement other retirement savings and provide a steady stream of income during retirement years.

- Debt Consolidation: Cash value can be used to consolidate high-interest debts, such as credit card balances, potentially reducing overall interest payments and improving financial stability.

- Home Improvements: Cash value can be tapped into for home renovations, repairs, or upgrades, enhancing the value of your property.

- Business Opportunities: Entrepreneurs may use cash value to fund new business ventures, providing a source of capital without resorting to traditional loans.

Accessing Cash Value for Emergencies or Investments

There are two main ways to access the cash value of a whole life insurance policy:

- Policy Loans: Policyholders can borrow against the cash value of their policy at a predetermined interest rate. This allows them to access funds without surrendering the policy. The interest accrued on the loan is typically deducted from the death benefit.

- Partial Surrenders: Policyholders can withdraw a portion of their cash value, reducing the death benefit accordingly. This option provides access to funds but may impact the policy’s future growth potential.

Tax Implications of Accessing Cash Value

It’s crucial to understand the tax implications of accessing cash value.

- Policy Loans: Interest accrued on policy loans is typically not taxable until the policy is surrendered or lapses. However, if the loan is not repaid, the outstanding balance will be deducted from the death benefit, reducing the amount payable to beneficiaries.

- Partial Surrenders: Withdrawals from cash value are generally considered taxable income to the extent that they exceed the amount of premiums paid into the policy. This is known as the “cost basis” rule.

Pros and Cons of Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and builds cash value. It offers a unique combination of death benefit protection and investment potential, making it a popular choice for individuals seeking long-term financial security. However, it’s crucial to understand both the advantages and disadvantages of whole life insurance before making a decision.

Advantages of Whole Life Insurance

Whole life insurance offers several benefits that can be attractive to certain individuals and financial situations.

- Lifelong Coverage: Whole life insurance provides coverage for the entire duration of the policyholder’s life, ensuring that their beneficiaries will receive a death benefit regardless of when they pass away. This provides peace of mind and financial security for loved ones.

- Cash Value Accumulation: A key feature of whole life insurance is the cash value component. A portion of each premium payment goes towards building cash value, which grows over time through interest accumulation. This cash value can be accessed by the policyholder through withdrawals, loans, or surrender of the policy.

- Guaranteed Minimum Return: Unlike investments in the stock market, which are subject to market fluctuations, whole life insurance policies typically offer a guaranteed minimum return on the cash value. This provides a degree of stability and predictability for the policyholder.

- Tax Advantages: Cash value growth and death benefit proceeds are generally tax-deferred, meaning that you don’t have to pay taxes on the earnings until you withdraw or receive the funds.

- Flexibility and Control: Policyholders have the flexibility to use the cash value component for various financial needs, such as funding retirement, paying for college expenses, or covering unexpected medical bills.

Disadvantages of Whole Life Insurance

While whole life insurance offers several advantages, it also has potential drawbacks that should be carefully considered.

- Higher Premiums: Compared to term life insurance, whole life insurance premiums are typically higher. This is because the premiums cover both the death benefit and the cash value component.

- Potential for Lower Returns: While whole life insurance guarantees a minimum return on the cash value, it may not always outperform other investment options, such as stocks or mutual funds.

- Complexity: Understanding the intricacies of whole life insurance policies, including the cash value accumulation and surrender charges, can be complex for some individuals.

- Limited Flexibility: Unlike some other types of life insurance, whole life insurance policies may have restrictions on policy changes or adjustments.

Alternatives to Whole Life Insurance

While whole life insurance offers lifelong coverage and cash value accumulation, it may not be the most suitable option for everyone. Other permanent life insurance options, such as universal life and indexed universal life, can offer flexibility and potentially higher returns.

Universal Life Insurance

Universal life insurance provides flexible premiums and death benefit options. It offers a cash value component that grows based on the interest rate credited to the policy. This interest rate is typically tied to market performance, offering the potential for higher returns than traditional whole life insurance. However, the policyholder bears the investment risk, and the cash value may fluctuate depending on market conditions.

- Pros:

- Flexibility in premium payments and death benefit adjustments.

- Potential for higher cash value growth due to market-linked interest rates.

- Cons:

- Higher risk of cash value fluctuations due to market volatility.

- More complex policy structure compared to whole life insurance.

Indexed Universal Life Insurance

Indexed universal life insurance combines the flexibility of universal life with the potential for growth linked to a specific market index, such as the S&P 500. The cash value grows based on the performance of the chosen index, providing a hedge against inflation and market downturns. However, the policyholder’s returns are capped, and the policy may have fees associated with index participation.

- Pros:

- Potential for higher cash value growth linked to market index performance.

- Protection against inflation and market downturns.

- Cons:

- Capped returns, limiting potential gains.

- Fees associated with index participation.

Comparing Whole Life, Universal Life, and Indexed Universal Life

| Feature | Whole Life | Universal Life | Indexed Universal Life |

|---|---|---|---|

| Premium Flexibility | Fixed | Flexible | Flexible |

| Death Benefit | Fixed | Adjustable | Adjustable |

| Cash Value Growth | Guaranteed minimum return | Market-linked interest rate | Index-linked returns |

| Risk | Low | Moderate | Moderate |

| Complexity | Simple | Complex | Complex |

Considerations Before Purchasing Whole Life Insurance

Whole life insurance is a long-term commitment, so it’s essential to carefully consider your financial goals and needs before making a purchase. This ensures that the policy aligns with your financial objectives and provides the desired coverage and benefits.

Understanding Your Financial Goals and Needs

Before considering whole life insurance, it’s crucial to understand your financial goals and needs. This includes determining your insurance needs, such as covering funeral expenses, protecting your family’s income, or paying off debts. Understanding your financial goals helps you determine if whole life insurance is the right fit for your needs and whether it aligns with your long-term financial strategy.

Choosing the Right Whole Life Insurance Policy

Selecting the right whole life insurance policy involves careful consideration of various factors, including:

- Death Benefit: The death benefit should be sufficient to meet your family’s needs, such as covering funeral expenses, debt payments, or providing income replacement.

- Premium Payments: Whole life insurance premiums are typically higher than term life insurance premiums. You need to ensure that you can afford the premiums throughout the policy’s term.

- Cash Value Growth: The cash value component of whole life insurance can grow over time, but it’s important to understand the factors that affect its growth, such as interest rates and the policy’s performance.

- Policy Features: Different whole life insurance policies offer various features, such as loan provisions, riders, and dividend options. Choose a policy that aligns with your specific needs and preferences.

Consulting with a Financial Advisor

Consulting with a qualified financial advisor is essential when considering whole life insurance. A financial advisor can help you:

- Assess your financial goals and needs: A financial advisor can help you determine if whole life insurance is the right fit for your situation.

- Compare different policy options: A financial advisor can help you compare different whole life insurance policies from various providers.

- Develop a comprehensive financial plan: A financial advisor can incorporate whole life insurance into your overall financial plan to ensure it aligns with your long-term goals.

Final Wrap-Up

Understanding how whole life insurance cash value accumulates is crucial for making informed financial decisions. By carefully analyzing the chart and considering the factors that influence cash value growth, individuals can gain a clear picture of their investment potential. Whether you’re looking to secure a legacy for your loved ones or create a financial safety net, a whole life insurance policy with a robust cash value component can be a valuable asset in your portfolio.