The insurance industry is undergoing a dramatic transformation, driven by the rise of mobile technology and the increasing demand for convenience and accessibility. At the forefront of this revolution are insurance apps, which are rapidly changing the way consumers interact with insurance providers. These apps offer a wide range of features and functionalities, from managing policies and filing claims to accessing personalized advice and comparing different insurance options.

Insurance apps have become indispensable tools for both consumers and insurance companies, streamlining processes, improving customer engagement, and enabling greater transparency and efficiency. The convenience and accessibility of these apps are reshaping the insurance landscape, empowering consumers to take control of their insurance needs while allowing insurance providers to better serve their customers and optimize their operations.

The Rise of Insurance Apps

The insurance industry is undergoing a digital transformation, with insurance apps playing a pivotal role in this evolution. Driven by factors such as technological advancements, changing consumer preferences, and a competitive market landscape, insurance apps are rapidly gaining popularity, reshaping the way insurance is bought, managed, and claimed.

Advantages for Consumers

Insurance apps offer numerous benefits to consumers, making the insurance process more convenient, accessible, and personalized.

- Enhanced Convenience: Insurance apps enable consumers to access insurance services anytime, anywhere, eliminating the need for physical visits to insurance offices or phone calls during office hours. Consumers can easily compare quotes, purchase policies, manage their accounts, file claims, and access policy documents through their smartphones or tablets.

- Personalized Experiences: Insurance apps leverage data analytics and machine learning to personalize the insurance experience for each individual. By analyzing user data, such as driving habits, health records, and financial history, apps can provide tailored quotes, recommendations, and risk assessments, offering customized insurance solutions that meet specific needs.

- Improved Communication: Insurance apps facilitate seamless communication between consumers and insurance providers. Users can access real-time information about their policies, track claim status, receive notifications about policy updates, and contact customer support directly through the app, eliminating the need for lengthy phone calls or emails.

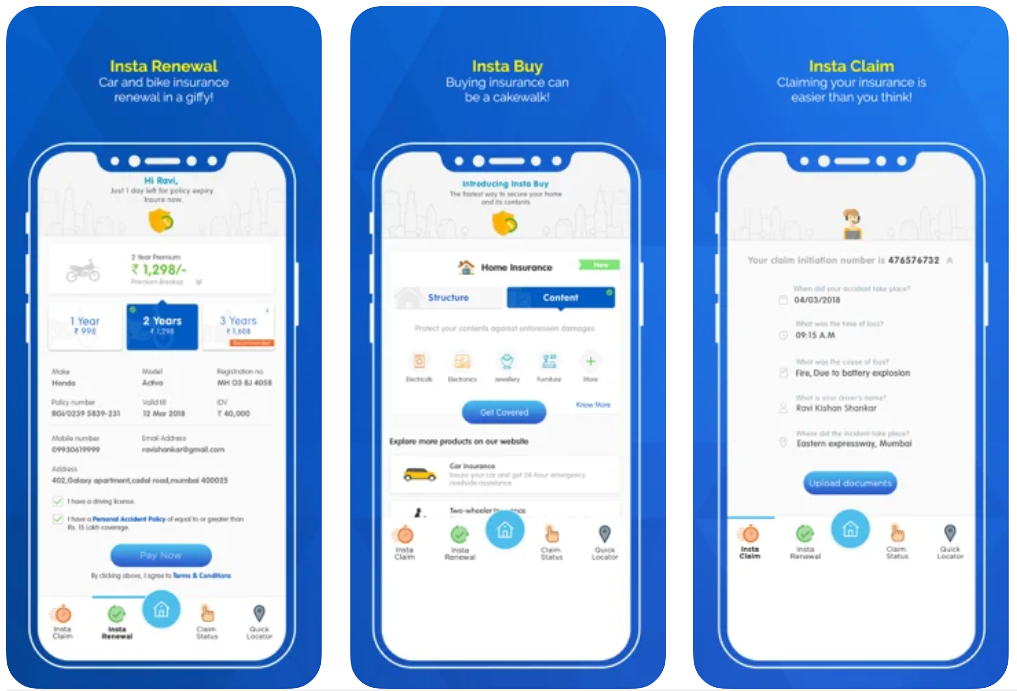

- Faster Claim Processing: Insurance apps streamline the claims process by enabling consumers to file claims electronically, submit supporting documents, and track claim progress in real-time. The automated workflows and digital communication features within apps significantly reduce the time required to process claims, providing faster payouts and improved customer satisfaction.

Advantages for Insurance Providers

Insurance apps also offer significant advantages to insurance providers, helping them enhance operational efficiency, improve customer engagement, and expand their reach.

- Reduced Operational Costs: Insurance apps automate many manual processes, such as policy administration, claims processing, and customer support, reducing the need for extensive human intervention. This automation leads to significant cost savings for insurance providers, enabling them to allocate resources more effectively.

- Enhanced Customer Engagement: Insurance apps provide insurance providers with valuable insights into customer behavior and preferences. By analyzing user data and interactions within the app, providers can gain a deeper understanding of their customer base, personalize communication, and offer targeted products and services that meet specific needs.

- Increased Reach and Market Penetration: Insurance apps allow providers to reach a wider audience, expanding their market reach beyond traditional channels. The convenience and accessibility offered by apps attract new customers who prefer digital solutions, enabling providers to acquire new business and grow their customer base.

- Improved Data Analytics: Insurance apps collect vast amounts of data about user behavior, policy usage, and claims history. This data can be analyzed to identify trends, assess risks, and develop more accurate pricing models, leading to improved underwriting decisions and risk management practices.

Examples of How Insurance Apps are Changing the Landscape

Insurance apps are transforming the insurance industry in various ways, disrupting traditional practices and introducing innovative solutions.

- Telematics-Based Insurance: Apps that track driving behavior, such as speed, braking, and acceleration, are revolutionizing auto insurance. These telematics apps provide data-driven insights into driving habits, enabling insurers to offer personalized premiums based on individual risk profiles. Companies like Progressive and Allstate have successfully implemented telematics programs, rewarding safe drivers with lower premiums.

- On-Demand Insurance: Insurance apps are making insurance more flexible and accessible by offering on-demand coverage. Consumers can purchase temporary insurance policies for specific events, such as short-term rentals or weekend trips, eliminating the need for traditional annual policies. This innovative approach to insurance caters to the needs of a growing segment of consumers who prefer flexible and cost-effective solutions.

- Artificial Intelligence (AI) and Chatbots: AI-powered chatbots are being integrated into insurance apps to provide instant customer support and answer common questions. These chatbots can handle routine inquiries, resolve simple issues, and provide personalized recommendations, freeing up human agents to focus on more complex tasks. Insurers are leveraging AI to enhance customer service, automate processes, and improve efficiency.

- Micro-Insurance: Insurance apps are making insurance accessible to underserved populations by offering micro-insurance products. These small, affordable insurance policies can provide coverage for specific risks, such as mobile phone damage, accidental injury, or unexpected medical expenses. Micro-insurance solutions offered through apps are expanding financial inclusion and providing insurance protection to individuals who may not have access to traditional insurance products.

Key Features of Insurance Apps

Insurance apps have become ubiquitous, offering consumers a convenient and streamlined way to manage their insurance needs. These apps offer a range of features designed to simplify the insurance process, from obtaining quotes to filing claims.

Core Features

Insurance apps typically offer a core set of features that cater to the most common insurance needs. These features include:

- Policy Management: Users can access and manage their insurance policies, including viewing policy details, making payments, and updating contact information.

- Quote Comparison: Apps allow users to compare quotes from different insurance providers, facilitating informed decision-making.

- Claims Filing: Users can file claims directly through the app, often with the ability to upload supporting documents and track claim status.

- Customer Support: Most apps provide access to customer support channels, such as live chat, email, or phone, allowing users to resolve queries or seek assistance.

Functionality of Different Insurance App Types

The features and functionalities of insurance apps vary depending on the type of insurance they cater to.

Health Insurance Apps

Health insurance apps offer a range of features tailored to the unique needs of health insurance policyholders. These features include:

- Finding Healthcare Providers: Users can search for doctors, hospitals, and other healthcare providers within their network.

- Managing Health Records: Apps may allow users to store and manage their medical records, including prescriptions and immunization history.

- Tracking Claims: Users can track the status of their health insurance claims and access claim details.

- Telemedicine: Some health insurance apps offer integrated telemedicine services, enabling users to consult with doctors remotely.

Life Insurance Apps

Life insurance apps are designed to simplify the process of obtaining and managing life insurance policies. They typically offer features such as:

- Quote Comparison: Users can compare quotes from different life insurance providers based on their needs and budget.

- Policy Management: Users can access and manage their life insurance policies, including viewing policy details, making payments, and updating beneficiary information.

- Beneficiary Management: Apps allow users to designate and manage beneficiaries for their life insurance policies.

Auto Insurance Apps

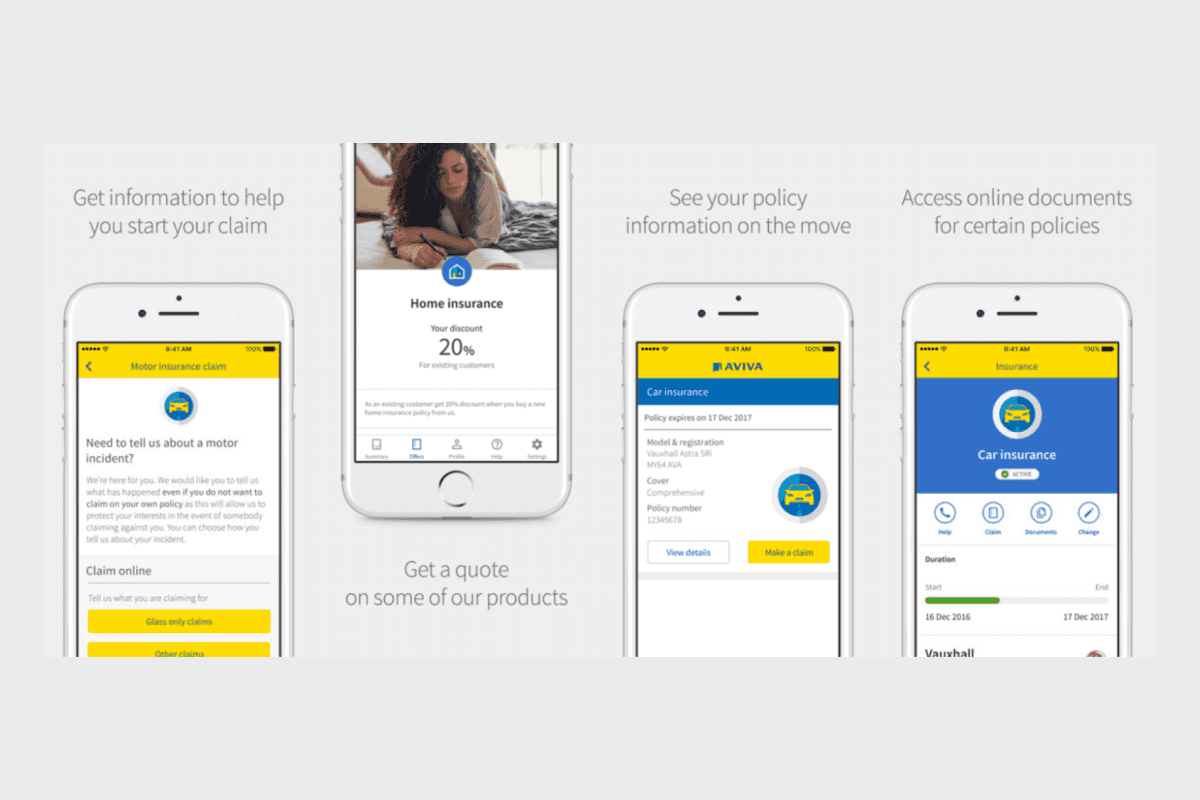

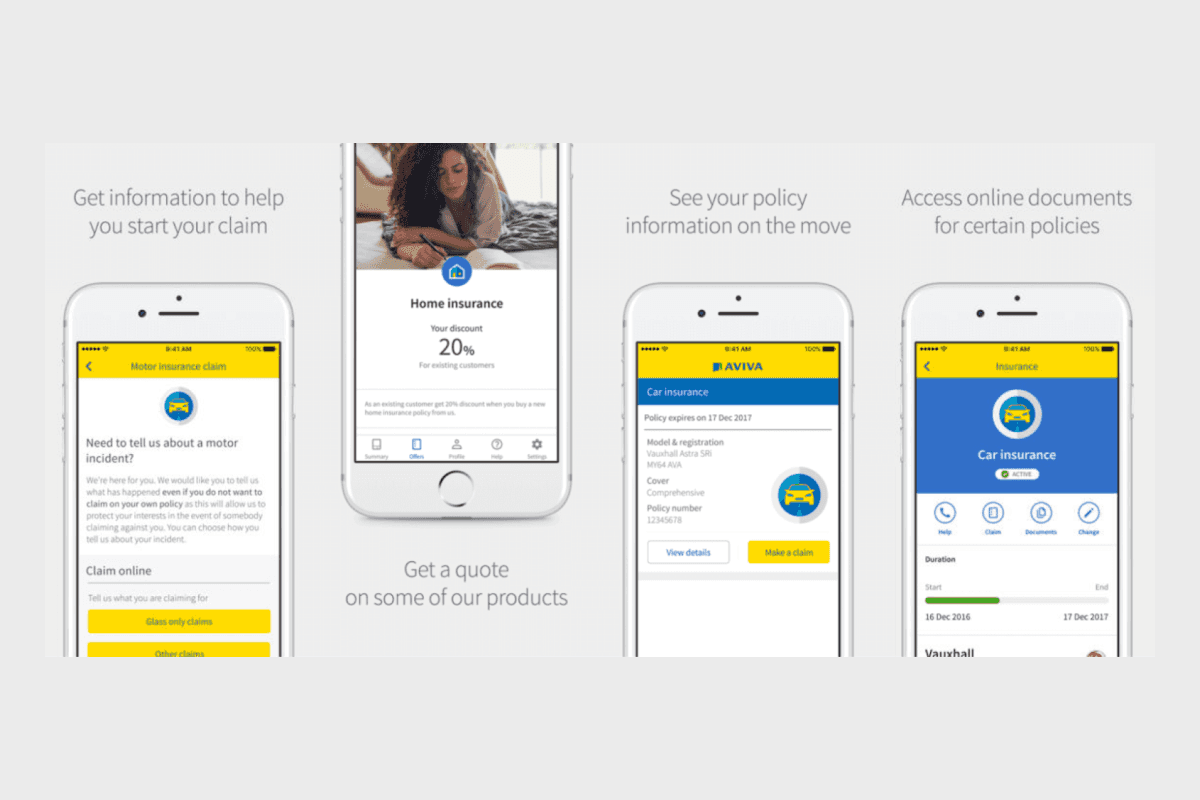

Auto insurance apps cater to the specific needs of car owners. Key features include:

- Policy Management: Users can manage their auto insurance policies, including viewing policy details, making payments, and updating vehicle information.

- Claims Filing: Users can file claims for accidents or other incidents, often with the ability to upload photos and track claim status.

- Roadside Assistance: Some auto insurance apps offer integrated roadside assistance services, providing users with access to towing, flat tire assistance, and other emergency services.

Role of Mobile-First Technologies

Insurance apps leverage mobile-first technologies to enhance the user experience and deliver seamless interactions.

- Push Notifications: Apps use push notifications to remind users about upcoming payments, policy renewals, or claim updates, ensuring timely action.

- Geolocation: Apps can use geolocation data to provide location-based services, such as finding nearby healthcare providers or roadside assistance.

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants can provide instant support and answer common insurance-related questions.

- Biometric Authentication: Apps use fingerprint or facial recognition for secure login, enhancing user privacy and security.

Benefits for Consumers

Insurance apps have revolutionized the way consumers interact with their insurance providers, offering greater convenience, accessibility, and control over their policies. These digital platforms have simplified insurance processes, empowered consumers to make informed decisions, and ultimately enhanced the overall customer experience.

Convenience and Accessibility

Insurance apps provide a convenient and accessible way for policyholders to manage their insurance needs from anywhere, anytime. With a few taps on their smartphone, consumers can access their policy information, make payments, file claims, and communicate with their insurer. This eliminates the need for phone calls, paperwork, or visits to physical offices, saving consumers time and effort.

Simplified Insurance Processes

Insurance apps streamline various insurance processes, making them more efficient and user-friendly. For example, filing a claim through an app is often a straightforward process, with clear instructions and real-time updates. Policyholders can upload photos and documents directly through the app, eliminating the need for physical forms and mail. Many apps also offer 24/7 access to customer support, providing immediate assistance when needed.

Empowering Informed Decisions

Insurance apps provide consumers with valuable tools to make informed decisions about their insurance needs. Apps often offer personalized recommendations based on individual risk profiles and lifestyle factors. They can also provide access to educational resources and comparison tools, allowing consumers to explore different coverage options and find the best fit for their circumstances. This transparency and access to information empower consumers to make confident choices about their insurance.

Benefits for Insurance Providers

Insurance apps offer a wealth of advantages for insurance providers, enabling them to streamline operations, enhance customer engagement, and gain valuable insights for improved risk assessment. These benefits translate into increased efficiency, reduced costs, and ultimately, a more competitive edge in the market.

Streamlining Operations and Reducing Administrative Costs

Insurance apps can significantly simplify and automate various aspects of the insurance process, leading to reduced administrative costs and increased operational efficiency.

- Automated Policy Management: Apps can facilitate the creation, modification, and renewal of policies, eliminating manual processes and reducing the potential for errors. This allows insurers to process policies more efficiently and free up staff for other tasks. For example, a customer can submit a claim through the app, complete with supporting documentation, and receive an instant response regarding the status of their claim.

- Simplified Claims Processing: Apps can expedite the claims process by allowing customers to submit claims electronically, upload supporting documents, and track the status of their claim in real-time. This reduces the need for physical paperwork and phone calls, saving time and resources for both the customer and the insurer. For instance, a customer can submit a claim through the app, complete with supporting documentation, and receive an instant response regarding the status of their claim.

- Reduced Paperwork: By digitizing insurance processes, apps minimize the need for paper-based documentation, leading to significant cost savings in printing, storage, and handling. This also contributes to a more sustainable approach to insurance operations. For instance, a customer can submit a claim through the app, complete with supporting documentation, and receive an instant response regarding the status of their claim.

Improved Customer Engagement and Loyalty

Insurance apps provide a platform for enhanced customer engagement and loyalty, fostering stronger relationships with policyholders.

- Personalized Communication: Apps allow insurers to communicate with customers in a personalized manner, sending tailored messages and notifications based on individual policy details and preferences. This can include reminders for premium payments, policy updates, and relevant offers. For example, an app can notify a customer about a new discount program based on their driving history.

- Interactive Features: Apps can incorporate interactive features, such as chatbots, FAQs, and virtual assistants, to provide customers with quick and convenient support. This can help address customer queries efficiently and improve their overall experience. For instance, a chatbot can help a customer find information about their policy or report a claim.

- Gamification: Some insurance apps incorporate gamification elements, such as rewards programs and challenges, to incentivize customers to engage with the app and adopt healthy behaviors. This can lead to increased customer satisfaction and loyalty. For example, an app can reward customers for completing a safe driving course or for participating in a health and wellness program.

Data Collection and Analytics for Better Risk Assessment

Insurance apps enable insurers to collect and analyze valuable data that can improve risk assessment and pricing models.

- Real-Time Data Collection: Apps can collect real-time data on customer behavior, such as driving habits, health metrics, and claims history. This data can provide a more accurate picture of risk compared to traditional methods based on historical data. For instance, a car insurance app can track a customer’s driving behavior and provide insights into their risk profile, allowing for personalized pricing.

- Enhanced Risk Modeling: The data collected through apps can be used to develop more sophisticated risk models, enabling insurers to better assess the likelihood of claims and set more accurate premiums. This can lead to more competitive pricing and improved profitability. For example, a health insurance app can track a customer’s health metrics and provide insights into their risk profile, allowing for personalized pricing.

- Targeted Marketing: Data collected through apps can be used to segment customers and target them with personalized marketing campaigns. This can lead to increased conversion rates and customer satisfaction. For example, an insurance app can identify customers who are likely to be interested in a new product based on their usage patterns and demographics.

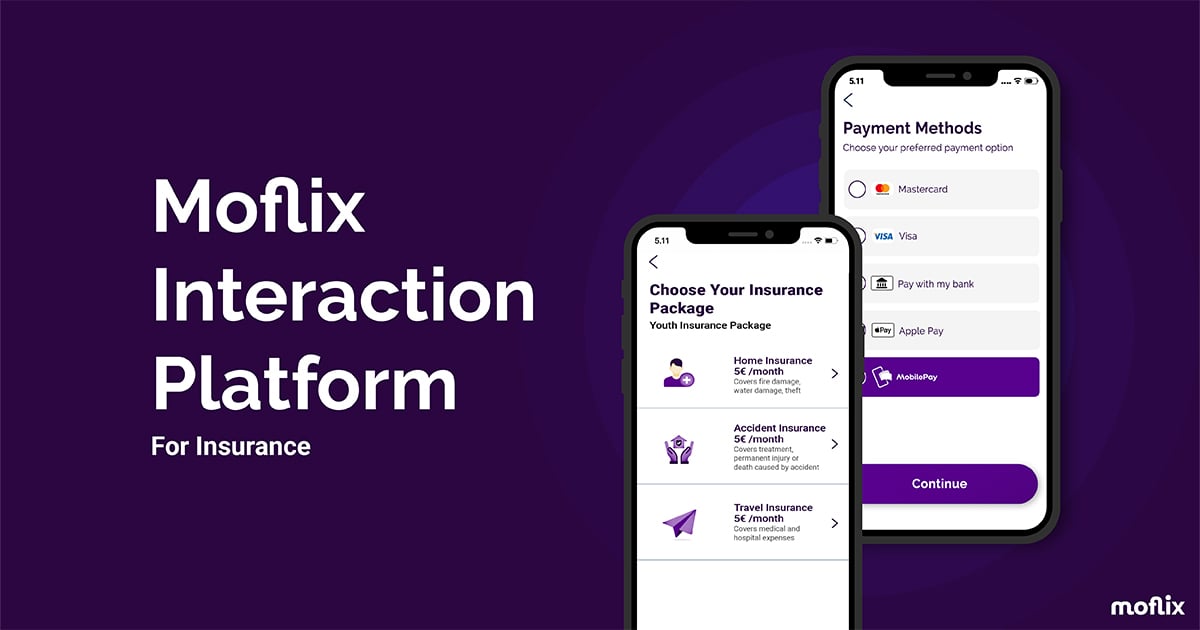

Types of Insurance Apps

Insurance apps have become increasingly popular, offering a wide range of functionalities and benefits to both consumers and insurance providers. These apps cater to various insurance needs, covering everything from health and life insurance to auto and home insurance.

Types of Insurance Apps

The different categories of insurance apps are designed to address specific insurance needs. These categories include:

| Category | Description | Examples |

|---|---|---|

| Health Insurance Apps | These apps allow users to manage their health insurance policies, track claims, find healthcare providers, and access other health-related information. |

|

| Life Insurance Apps | These apps allow users to obtain life insurance quotes, compare policies, and apply for coverage online. |

|

| Auto Insurance Apps | These apps provide users with access to their auto insurance policies, track claims, find nearby repair shops, and manage roadside assistance. |

|

| Home Insurance Apps | These apps allow users to manage their home insurance policies, track claims, access emergency services, and find local contractors. |

|

Security and Privacy Concerns

The increasing adoption of insurance apps raises concerns about the security and privacy of sensitive personal information. Insurance apps often collect and store extensive data about users, including their health records, financial details, and driving history. This data can be attractive targets for cybercriminals, who may attempt to steal or misuse it for malicious purposes.

Data Encryption and User Authentication

Protecting user data is paramount. Robust security measures, including data encryption and strong user authentication, are essential to mitigate security risks. Data encryption converts sensitive information into an unreadable format, making it difficult for unauthorized individuals to access. Strong user authentication, such as multi-factor authentication, adds an extra layer of security by requiring users to provide multiple forms of identification before granting access to their accounts.

Recommendations for Safeguarding Personal Information

Users can take several steps to protect their personal information when using insurance apps.

- Download apps only from trusted sources, such as official app stores.

- Enable multi-factor authentication for all accounts.

- Use strong and unique passwords for each app.

- Be cautious about clicking on suspicious links or attachments in emails or messages.

- Regularly review app permissions and disable any unnecessary access to personal data.

- Keep app software updated to ensure the latest security patches are installed.

- Be aware of phishing scams that may attempt to trick users into revealing sensitive information.

The Future of Insurance Apps

The insurance industry is on the cusp of a digital revolution, with insurance apps poised to become even more central to the customer experience. Emerging technologies like artificial intelligence (AI), blockchain, and wearables are driving significant innovation, shaping the future of insurance apps and redefining the relationship between insurers and policyholders.

The Role of AI in Insurance Apps

AI is transforming the insurance landscape by automating tasks, personalizing experiences, and enhancing risk assessment. AI-powered chatbots are already being used by insurance companies to provide instant customer support, answering queries and resolving issues 24/7. AI algorithms are also being employed to analyze vast amounts of data to identify patterns and predict risks, enabling insurers to offer more accurate and personalized pricing.

- Personalized Risk Assessment: AI algorithms can analyze data from various sources, including wearable devices, social media, and driving records, to create a more accurate picture of an individual’s risk profile. This allows insurers to offer tailored premiums based on actual risk rather than broad demographic categories.

- Fraud Detection: AI algorithms can detect fraudulent claims by analyzing patterns in data, such as claim history, medical records, and social media activity. This can help insurers reduce fraudulent claims and lower overall costs.

- Enhanced Customer Experience: AI-powered chatbots can provide instant customer support, answering queries and resolving issues 24/7. This can improve customer satisfaction and reduce the need for human interaction.

Blockchain’s Impact on Insurance Apps

Blockchain technology offers a secure and transparent platform for managing insurance transactions, streamlining processes, and improving trust. Blockchain’s decentralized nature eliminates the need for intermediaries, reducing transaction costs and increasing efficiency. This can benefit both insurers and policyholders by simplifying the claims process, enabling faster payouts, and increasing transparency.

- Streamlined Claims Processing: Blockchain can automate the claims process, reducing the time and paperwork involved. This can benefit both insurers and policyholders by ensuring faster payouts and reducing administrative costs.

- Increased Transparency: Blockchain provides a transparent record of all transactions, which can help build trust between insurers and policyholders. This can improve customer satisfaction and reduce disputes.

- Enhanced Security: Blockchain’s decentralized nature makes it highly secure, reducing the risk of fraud and data breaches. This can enhance the security of insurance apps and protect sensitive customer information.

Wearables and the Future of Insurance

Wearable devices are transforming the insurance industry by providing insurers with real-time data about policyholders’ health and lifestyle. This data can be used to personalize insurance policies, offer discounts for healthy behavior, and provide more accurate risk assessments.

- Personalized Health Insurance: Wearable devices can track a user’s activity levels, sleep patterns, and heart rate, providing insurers with valuable insights into their health. This data can be used to personalize health insurance policies and offer discounts for healthy behavior.

- Predictive Analytics: Wearable devices can provide early warnings of potential health issues, allowing insurers to intervene proactively and reduce the risk of expensive claims.

- Usage-Based Insurance: Wearable devices can track driving behavior, such as speed, braking, and acceleration, allowing insurers to offer usage-based insurance policies that reward safe driving.

A Hypothetical Future Scenario

Imagine a future where insurance apps are seamlessly integrated into our lives, leveraging AI, blockchain, and wearables to provide personalized and proactive insurance solutions. A person’s insurance app might track their health data through a wearable device, automatically adjusting their health insurance premiums based on their activity levels and risk profile. The app could also leverage blockchain technology to streamline the claims process, providing instant payouts for approved claims. AI-powered chatbots could provide 24/7 customer support, answering questions and resolving issues quickly and efficiently. This future scenario represents a vision of a more personalized, efficient, and transparent insurance industry, where insurance apps play a central role in connecting insurers and policyholders.

Case Studies of Successful Insurance Apps

The insurance industry has seen a significant rise in the adoption of mobile apps, with many companies achieving remarkable success. These apps have revolutionized the way consumers interact with insurance providers, offering convenience, transparency, and personalized services. Analyzing the success stories of these apps provides valuable insights into the key factors that contribute to their widespread adoption and can guide future app development efforts.

Examples of Successful Insurance Apps

The success of insurance apps is evident in the widespread adoption and positive user feedback they receive. Here are some prominent examples:

- Lemonade: This app-based insurance provider offers homeowners, renters, and pet insurance with a focus on simplicity and speed. Lemonade leverages artificial intelligence (AI) to streamline the claims process, allowing policyholders to file claims through a chatbot and receive payouts within minutes. Its user-friendly interface and innovative features have contributed to its rapid growth and positive customer reviews.

- Root: This app-based car insurance provider uses telematics technology to monitor driving behavior and offer personalized premiums based on actual driving habits. The app provides real-time feedback on driving performance and rewards safe driving practices with lower premiums. Its data-driven approach and emphasis on transparency have attracted a large user base.

- Oscar Health: This health insurance company offers a comprehensive mobile app that allows users to manage their health insurance plans, access medical records, schedule appointments, and find nearby healthcare providers. The app’s intuitive design and seamless integration with healthcare providers have made it a popular choice among consumers seeking a convenient and personalized healthcare experience.

Key Factors Contributing to Success

Several key factors contribute to the success of these insurance apps:

- User-Friendly Design and Interface: Insurance apps need to be intuitive and easy to navigate, catering to a diverse user base. Simple navigation, clear information, and personalized features are essential for user engagement and satisfaction.

- Personalized Experience: Insurance apps should offer tailored services based on individual needs and preferences. This includes personalized quotes, policy recommendations, and claims assistance. Using data analytics and AI can enhance personalization and improve user satisfaction.

- Seamless Integration with Other Services: Integrating with other services like banking, healthcare providers, and other financial platforms can enhance the overall user experience and provide a more holistic approach to insurance management.

- Focus on Transparency and Communication: Open communication and transparency are crucial for building trust with users. Apps should provide clear and concise information about policies, coverage, and claims processes, fostering a sense of confidence and control.

- Innovative Features and Technology: Leveraging innovative technologies like AI, blockchain, and telematics can create unique and valuable features that differentiate insurance apps and enhance the user experience.

Lessons for Future App Development

The success stories of these insurance apps offer valuable lessons for future app development:

- Prioritize User Experience: The success of any app hinges on its user experience. Invest in intuitive design, seamless navigation, and personalized features to create a positive and engaging experience for users.

- Embrace Technology and Innovation: Continuously explore and integrate emerging technologies to create innovative features and improve the overall user experience. This includes AI, blockchain, and telematics, which can revolutionize the way insurance is delivered and consumed.

- Focus on Transparency and Trust: Transparency and clear communication are essential for building trust with users. Provide accurate information about policies, coverage, and claims processes, and prioritize user feedback and communication.

- Data-Driven Approach: Leverage data analytics to understand user behavior, personalize services, and optimize app performance. This can help identify user needs, improve app functionality, and create a more tailored experience.

Challenges and Opportunities

The rise of insurance apps has brought a wave of innovation to the insurance industry, but it also presents unique challenges and opportunities for app developers. These challenges range from fierce competition to regulatory compliance, while opportunities for growth and innovation abound. Understanding these dynamics is crucial for app developers to navigate the evolving insurance landscape effectively.

Competition

The insurance app market is becoming increasingly competitive, with established players and new entrants vying for market share. This competition manifests in various ways:

- Price Wars: Companies are constantly lowering premiums to attract customers, leading to a price war that can erode profit margins.

- Feature Wars: App developers are adding new features and functionalities to differentiate themselves from competitors, leading to a race to provide the most comprehensive and user-friendly experience.

- Marketing and Advertising: Companies are investing heavily in marketing and advertising to reach their target audiences, leading to a crowded and noisy market.

This intense competition forces app developers to continuously innovate and improve their offerings to stay ahead of the curve.

Regulatory Compliance

The insurance industry is heavily regulated, and app developers must comply with a complex web of rules and regulations. These regulations vary by jurisdiction and can be challenging to navigate:

- Data Privacy and Security: App developers must ensure that they collect, store, and process user data in compliance with privacy laws like GDPR and CCPA.

- Financial Regulations: Insurance apps often handle sensitive financial information, requiring compliance with regulations like the Bank Secrecy Act and the Fair Credit Reporting Act.

- Insurance Licensing: App developers may need to obtain licenses or registrations in different states or countries to operate legally.

Staying abreast of evolving regulations and ensuring compliance is essential for app developers to avoid legal and reputational risks.

Opportunities for Innovation

Despite the challenges, the insurance app market presents significant opportunities for innovation and growth:

- Personalized Insurance: Apps can leverage data analytics to provide personalized insurance products and services tailored to individual needs and risk profiles.

- Artificial Intelligence (AI): AI can be used to automate processes, improve risk assessment, and enhance customer service through chatbots and virtual assistants.

- Blockchain Technology: Blockchain can streamline insurance claims processing, improve transparency, and reduce fraud.

- Internet of Things (IoT): Connected devices can provide real-time data on risk factors, enabling insurers to offer more accurate and affordable policies.

By embracing these emerging technologies, app developers can create innovative solutions that enhance the customer experience and drive growth.

Solutions to Address Challenges

To navigate the challenges and capitalize on the opportunities, insurance app developers can consider the following solutions:

- Focus on Differentiation: App developers should focus on creating unique value propositions and features that differentiate themselves from competitors. This could include offering specialized insurance products, developing innovative user interfaces, or leveraging AI to personalize the customer experience.

- Embrace Regulatory Compliance: App developers should proactively embrace regulatory compliance by building data privacy and security into their app development processes from the outset. They should also seek legal advice and stay updated on evolving regulations.

- Invest in Technology: App developers should invest in emerging technologies like AI, blockchain, and IoT to create innovative solutions that enhance customer experiences and drive efficiency.

- Build Strong Partnerships: Collaborating with other companies in the insurance ecosystem, such as brokers, agents, and technology providers, can provide access to new markets, expertise, and resources.

- Focus on Customer Experience: App developers should prioritize creating a seamless and user-friendly experience for customers, making it easy to purchase insurance, file claims, and manage policies.

By implementing these solutions, insurance app developers can overcome the challenges and capitalize on the opportunities presented by the rapidly evolving insurance landscape.

Impact on the Insurance Industry

Insurance apps are rapidly transforming the insurance industry, driving significant changes in how insurance is bought, sold, and managed. These apps are redefining the customer experience, challenging traditional business models, and opening up new opportunities for innovation.

Impact on Traditional Insurance Companies

The rise of insurance apps poses both challenges and opportunities for traditional insurance companies. These companies must adapt to the changing landscape by embracing technology and modernizing their operations.

- Increased Competition: Insurance apps create a more competitive market, forcing traditional insurers to compete with agile, tech-savvy startups offering innovative products and services.

- Shifting Customer Expectations: Consumers are demanding more personalized and convenient insurance experiences, which traditional companies must deliver to remain competitive.

- Need for Digital Transformation: Traditional insurers must invest in digital transformation initiatives, including developing their own apps and integrating them into their existing systems.

Democratization of Access to Insurance

Insurance apps have the potential to democratize access to insurance and financial services, extending coverage to previously underserved populations.

- Increased Accessibility: Apps can reach a wider audience, including those in rural areas or with limited access to traditional insurance channels.

- Simplified Processes: Apps streamline the insurance process, making it easier for individuals to understand and purchase policies.

- Micro-Insurance Solutions: Apps enable the development of micro-insurance products tailored to specific needs and affordability levels.

Ending Remarks

The future of insurance is undeniably mobile, with insurance apps playing a pivotal role in shaping the industry’s trajectory. As technology continues to evolve, we can expect to see even more innovative features and functionalities integrated into these apps, further enhancing the user experience and driving greater adoption. The convenience, accessibility, and personalization offered by insurance apps are poised to transform the way we think about insurance, making it more accessible, efficient, and customer-centric than ever before.