Navigating the world of auto insurance in Maryland can feel like driving through a maze, especially when you’re seeking the most affordable rates. The state’s unique insurance regulations and diverse market of providers can leave drivers feeling overwhelmed. But don’t worry, we’re here to demystify the process and equip you with the knowledge to secure the best possible deal on your Maryland auto insurance.

From understanding the mandatory coverages and factors that influence rates to exploring strategies for lowering your premiums, this guide will provide you with a comprehensive roadmap to navigate the Maryland auto insurance landscape and find the cheapest options available.

Understanding Maryland Auto Insurance Basics

Maryland law requires all drivers to carry minimum liability insurance to protect themselves and others in case of an accident. This ensures financial responsibility for any damages or injuries caused. Understanding the different types of coverage and the factors that influence rates can help you make informed decisions about your insurance needs.

Mandatory Insurance Requirements

Maryland law mandates specific types of auto insurance coverage to ensure financial protection in case of an accident. These requirements include:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Maryland requires a minimum of $30,000 per person and $60,000 per accident for bodily injury liability and $15,000 for property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. Maryland requires a minimum of $30,000 per person and $60,000 per accident for both UM and UIM coverage.

Types of Auto Insurance Coverage

In addition to the mandatory requirements, you can choose to purchase additional coverage options to further protect yourself and your vehicle. Some common types of coverage include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is usually optional, but it may be required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It is also usually optional.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault. Maryland offers optional PIP coverage, and drivers can choose different levels of coverage.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of fault. It is typically a smaller amount of coverage than PIP.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with services such as towing, flat tire changes, and jump starts.

Factors Influencing Auto Insurance Rates

Several factors can influence the cost of your auto insurance in Maryland. Understanding these factors can help you manage your insurance costs:

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance rates. Drivers with a clean record typically pay lower premiums.

- Vehicle Type and Age: The type and age of your vehicle influence insurance rates. Newer, more expensive vehicles generally have higher insurance premiums due to higher repair costs.

- Location: The location where you live can affect your insurance rates. Areas with higher accident rates or crime rates tend to have higher insurance premiums.

- Credit Score: In some states, including Maryland, insurance companies may use your credit score to determine your insurance rates. Drivers with good credit scores typically pay lower premiums.

- Driving Habits: Your driving habits, such as mileage, commuting distance, and driving style, can influence your insurance rates. Drivers who commute long distances or drive frequently may pay higher premiums.

- Insurance Coverage and Deductibles: The type and amount of coverage you choose, as well as your deductibles, affect your insurance rates. Higher deductibles generally lead to lower premiums.

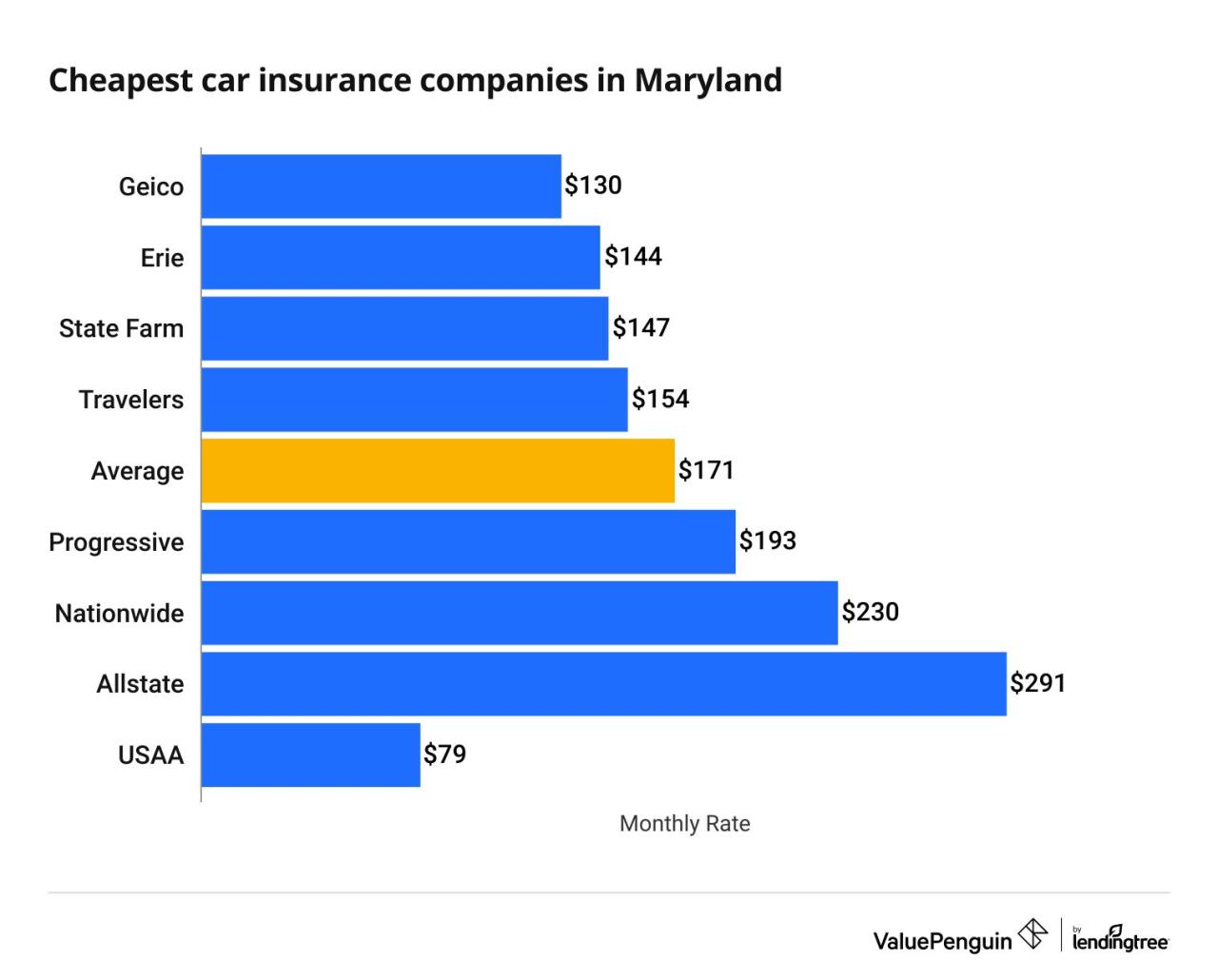

Finding Cheap Maryland Auto Insurance Options

Securing affordable auto insurance in Maryland is a priority for many drivers. A proactive approach to finding the best rates involves exploring different insurance companies and comparing their offerings.

Comparing Quotes from Multiple Providers

Obtaining quotes from various insurance companies is a crucial step in securing the most competitive rates. By comparing quotes, you can identify the insurer that best aligns with your needs and budget. The process of comparing quotes allows you to:

* Identify the lowest premiums: Different insurers offer varying rates based on factors such as driving history, vehicle type, and coverage options. Comparing quotes enables you to pinpoint the insurer with the most favorable pricing.

* Explore diverse coverage options: Each insurer offers a range of coverage options, such as liability, collision, and comprehensive. Comparing quotes helps you understand the coverage levels available and choose the package that best suits your needs.

* Negotiate better rates: Armed with quotes from multiple insurers, you can leverage this information to negotiate more favorable rates with your preferred company.

Methods for Obtaining Accurate Insurance Quotes

There are several methods to obtain accurate insurance quotes:

* Online Quote Tools: Many insurance companies offer online quote tools that allow you to input your information and receive an instant estimate. This method is convenient and time-saving, providing a quick overview of potential rates.

* Phone Calls: Contacting insurance companies directly via phone allows you to discuss your specific needs and obtain a personalized quote. This method enables you to clarify any questions and ensure you understand the details of the quote.

* Insurance Brokers: Insurance brokers act as intermediaries, comparing quotes from multiple insurers on your behalf. This service can be beneficial if you are overwhelmed by the process or need expert guidance.

Comparing Key Features and Rates of Major Maryland Insurance Companies

| Insurance Company | Average Annual Premium | Key Features |

|---|---|---|

| Geico | $1,200 | Wide coverage options, online quote tool, 24/7 customer service. |

| State Farm | $1,300 | Strong customer satisfaction ratings, extensive agent network, discounts for good drivers. |

| Progressive | $1,150 | Name Your Price tool, online quote tool, discounts for bundling policies. |

| Allstate | $1,250 | Strong financial stability, comprehensive coverage options, discounts for safe driving. |

| USAA | $1,100 | Exclusive to military members and their families, competitive rates, excellent customer service. |

Note: Average annual premiums are estimates and can vary based on individual factors such as driving history, vehicle type, and coverage options.

Strategies for Lowering Your Auto Insurance Premium

Maryland auto insurance rates can vary widely, and understanding the factors that influence your premium can help you save money. By implementing strategies to lower your risk profile and take advantage of available discounts, you can significantly reduce your monthly insurance costs.

Discounts Offered by Maryland Insurance Companies

Many Maryland insurance companies offer a variety of discounts to policyholders. Taking advantage of these discounts can significantly lower your premium.

- Good Driver Discount: This is a common discount offered to drivers with a clean driving record. Maintaining a safe driving history is crucial for obtaining this discount.

- Safe Driver Discount: Similar to the good driver discount, this reward is given to drivers who have completed defensive driving courses or have a proven history of safe driving practices.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount incentivizes bundling your insurance policies for greater savings.

- Multi-Policy Discount: This discount is available to policyholders who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance.

- Loyalty Discount: Some insurance companies offer loyalty discounts to customers who have been with them for a certain period.

- Student Discount: This discount is available to students who maintain good grades and are enrolled in a college or university.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS trackers, can significantly reduce your risk of theft and qualify you for a discount.

- Telematics Discount: Some insurance companies offer discounts based on your driving behavior. By using a telematics device, such as a smartphone app, your insurer can track your driving habits and reward you for safe driving.

- Paperless Billing Discount: Opting for paperless billing can help insurance companies save on printing and mailing costs, which can result in a discount for you.

Improving Your Driving Record

A clean driving record is crucial for securing lower insurance premiums. Avoiding traffic violations, accidents, and driving under the influence can significantly impact your rates.

- Defensive Driving Course: Completing a defensive driving course can help you improve your driving skills and reduce your risk of accidents.

- Maintain a Safe Driving Record: This is essential for securing discounts and avoiding rate increases.

- Avoid Traffic Violations: Every violation can lead to higher premiums.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs can result in significant penalties and higher insurance rates.

Optimizing Your Car’s Safety Features

Investing in safety features for your car can not only enhance your safety but also lower your insurance premium.

- Anti-lock Braking System (ABS): ABS helps prevent your wheels from locking up during braking, improving control and reducing the risk of accidents.

- Electronic Stability Control (ESC): ESC helps maintain control of your vehicle during challenging driving conditions, such as slippery roads or sharp turns.

- Airbags: Airbags can significantly reduce the severity of injuries in an accident.

- Daytime Running Lights (DRL): DRLs increase visibility during daylight hours, making your car more visible to other drivers and reducing the risk of accidents.

Understanding Maryland’s “No-Fault” System

Maryland’s “no-fault” auto insurance system, also known as Personal Injury Protection (PIP), is a unique aspect of the state’s insurance landscape. This system focuses on providing coverage for your own injuries and medical expenses, regardless of who is at fault in an accident.

Understanding Maryland’s No-Fault System

Maryland’s no-fault system operates on the principle that your own insurance policy will cover your medical expenses and lost wages, regardless of who caused the accident. This system is designed to streamline the claims process and reduce the number of lawsuits related to minor accidents. However, it’s important to understand the nuances of this system to ensure you receive the coverage you need.

Filing a Claim Under Maryland’s No-Fault System

When you’re involved in an accident in Maryland, the first step is to contact your insurance company and report the accident. Your insurance company will then initiate the claims process under the PIP coverage of your policy. Here’s a step-by-step guide to filing a claim:

- Report the accident to your insurance company: This is the first step in the claims process. Be sure to provide all the necessary details of the accident, including the date, time, location, and any other relevant information.

- Seek medical attention: If you’ve sustained injuries in the accident, it’s crucial to seek medical attention promptly. This will help document your injuries and ensure you receive the necessary treatment.

- Submit a claim form: Your insurance company will provide you with a claim form that you need to fill out and submit. This form will require details about the accident, your injuries, and your medical expenses.

- Provide documentation: To support your claim, you’ll need to provide your insurance company with relevant documentation, such as medical bills, police reports, and witness statements.

- Follow up with your insurance company: Once you’ve submitted your claim, it’s important to follow up with your insurance company regularly to track the progress of your claim and address any questions or concerns you may have.

Navigating the Claims Process

While the no-fault system aims to simplify the claims process, there are still some key points to keep in mind to ensure a smooth experience:

- Know your policy limits: Maryland law requires a minimum PIP coverage of $2,500, but you can opt for higher coverage limits. Understand your policy’s limits to know how much coverage you have for medical expenses and lost wages.

- Understand the time limits: You have a limited time to file a claim under Maryland’s no-fault system. Be sure to familiarize yourself with the deadlines to ensure you don’t miss out on coverage.

- Consult with an attorney: If you’re facing difficulties with the claims process or have questions about your rights, it’s advisable to consult with an attorney specializing in insurance law.

The Importance of Choosing the Right Coverage

Maryland auto insurance, like in any other state, offers a range of coverage options. While some are mandatory, others are optional. Choosing the right coverage is crucial for financial protection in case of an accident.

Liability Coverage

Liability coverage is mandatory in Maryland and protects you financially if you cause an accident. It covers the other driver’s medical expenses, lost wages, and property damage. The minimum liability limits in Maryland are:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $15,000 for property damage per accident

While these are the minimums, it is advisable to consider higher limits, especially if you have assets to protect. Higher limits provide more coverage and peace of mind.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. This coverage is optional, and it’s typically not required by lenders.

- Cost: This coverage can be expensive, particularly for newer or high-value vehicles.

- Benefit: It provides financial protection if your vehicle is damaged in an accident, even if you are at fault.

Comprehensive Coverage

Comprehensive coverage protects you from damage to your vehicle caused by non-accident events such as theft, vandalism, fire, or natural disasters. It is optional and not required by lenders.

- Cost: This coverage can be expensive, particularly for newer or high-value vehicles.

- Benefit: It provides financial protection for your vehicle against a wide range of non-accident events.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you in case you are hit by a driver without insurance or with insufficient insurance. This coverage pays for your medical expenses, lost wages, and property damage. It is optional but highly recommended, as it offers protection in situations where the other driver’s insurance is inadequate or non-existent.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” coverage, pays for your medical expenses and lost wages regardless of who caused the accident. It is mandatory in Maryland and provides coverage up to $2,500 for medical expenses and $250 per week for lost wages.

Factors to Consider When Choosing Coverage

- Your Budget: Higher coverage limits typically mean higher premiums. You need to find a balance between affordability and adequate protection.

- The Value of Your Vehicle: For older or less valuable vehicles, collision and comprehensive coverage may not be necessary.

- Your Driving Record: A clean driving record can help you secure lower premiums.

- Your Financial Situation: Consider your assets and potential financial exposure if you are involved in an accident.

- Your Lifestyle: If you frequently drive in high-risk areas or have a long commute, you may want to consider higher coverage limits.

Navigating Maryland’s Insurance Regulations

Maryland has a comprehensive set of auto insurance regulations designed to protect drivers and ensure fair treatment. These regulations cover various aspects, from minimum coverage requirements to dispute resolution processes. Understanding these regulations is crucial for Maryland drivers to make informed decisions about their insurance needs and ensure compliance.

The Role of the Maryland Insurance Administration

The Maryland Insurance Administration (MIA) plays a pivotal role in overseeing the state’s auto insurance market. It is responsible for enforcing insurance regulations, protecting consumers, and ensuring the financial stability of insurance companies.

The MIA performs several key functions, including:

- Licensing and Regulating Insurance Companies: The MIA grants licenses to insurance companies operating in Maryland and sets standards for their financial solvency and operational practices.

- Setting Minimum Coverage Requirements: The MIA establishes minimum coverage requirements for all drivers in Maryland, ensuring that they have adequate financial protection in case of an accident.

- Monitoring Insurance Rates: The MIA monitors insurance rates to ensure they are fair and reasonable, preventing excessive price increases or discriminatory practices.

- Resolving Consumer Complaints: The MIA investigates and resolves consumer complaints related to auto insurance, acting as a mediator between policyholders and insurers.

- Educating Consumers: The MIA provides educational resources and information to consumers about auto insurance, helping them understand their rights and obligations.

The Process for Filing Complaints or Disputes

If you have a complaint or dispute related to your auto insurance, the MIA provides a formal process for resolving the issue. Here are the steps involved:

- Contact Your Insurance Company: First, attempt to resolve the issue directly with your insurance company. Most insurance companies have a dedicated customer service department or a complaint resolution process.

- File a Complaint with the MIA: If you are unable to reach a satisfactory resolution with your insurance company, you can file a complaint with the MIA. The MIA provides an online complaint form on its website.

- MIA Investigation: The MIA will investigate your complaint and attempt to mediate a resolution between you and your insurance company.

- Formal Hearing: If mediation fails, the MIA may schedule a formal hearing to resolve the dispute. Both you and your insurance company have the right to present evidence and arguments.

- MIA Decision: The MIA will issue a decision based on the evidence presented at the hearing. This decision is binding on both you and your insurance company.

It is essential to keep records of all communication with your insurance company, including dates, times, and details of conversations or correspondence. This documentation can be helpful if you need to file a complaint with the MIA.

The Role of Technology in Finding Cheap Insurance

Technology has revolutionized the way we find and manage insurance, making it easier than ever to compare quotes, buy policies, and access support. By leveraging online platforms and mobile apps, consumers can save time and money while enjoying greater control over their insurance needs.

Online Insurance Comparison Platforms

Online insurance comparison platforms are a powerful tool for finding cheap Maryland auto insurance. These platforms allow you to enter your information once and receive quotes from multiple insurance companies simultaneously. This saves you the time and effort of contacting each insurer individually.

- Wide Selection: These platforms typically partner with a wide range of insurance companies, providing you with a diverse range of options to choose from.

- Easy Comparison: You can quickly compare quotes side-by-side, allowing you to identify the most competitive rates based on your specific needs.

- Transparent Pricing: Most platforms display the key factors influencing the price of each quote, such as coverage limits, deductibles, and discounts. This transparency helps you understand the pricing structure and make informed decisions.

Mobile Apps for Managing Insurance Policies

Mobile apps are transforming how we manage our insurance policies. They offer a range of features that simplify tasks and provide greater convenience.

- Policy Access: You can access your policy documents, payment history, and coverage details anytime, anywhere.

- Claims Reporting: Many apps allow you to file claims directly from your phone, often with the ability to upload photos and documents for faster processing.

- Roadside Assistance: Some apps provide access to roadside assistance services, such as towing or flat tire repair, directly through the app.

- Payment Options: You can manage payments, view payment history, and set up automatic payments directly through the app.

Technology Streamlines the Insurance Buying Process

Technology has significantly streamlined the insurance buying process, making it more efficient and user-friendly.

- Online Applications: You can complete the entire application process online, eliminating the need for paperwork and in-person meetings.

- Digital Signatures: Many platforms allow you to electronically sign documents, eliminating the need for physical signatures.

- Instant Quotes: You can receive instant quotes online, eliminating the need to wait for phone calls or emails.

- Automated Policy Management: Some platforms offer automated policy management features, such as renewal reminders and payment notifications.

Factors Influencing Insurance Rates for Young Drivers

Young drivers often face higher insurance premiums compared to older drivers. This is due to several factors that insurers consider, reflecting the increased risk associated with less experienced drivers.

Factors Contributing to Higher Premiums for Young Drivers

Insurers use a variety of factors to assess risk and determine premiums. These factors are particularly significant for young drivers due to their lack of experience and statistical likelihood of being involved in accidents.

- Inexperience: Young drivers have less experience behind the wheel, making them more likely to be involved in accidents. Insurers recognize this lack of experience and adjust premiums accordingly.

- Higher Risk-Taking Behavior: Statistics show that young drivers are more prone to engaging in risky behaviors like speeding, driving under the influence, and distracted driving. These behaviors increase the likelihood of accidents, leading to higher insurance rates.

- Limited Driving History: Insurers rely on driving history to assess risk. Young drivers have a shorter driving history, providing less data for insurers to evaluate their driving habits and predict future risk.

Strategies for Young Drivers to Lower Insurance Costs

While young drivers face higher premiums, there are steps they can take to mitigate these costs.

- Maintain a Good Driving Record: Avoiding accidents, traffic violations, and other driving offenses is crucial. A clean driving record demonstrates responsible driving habits and can lead to lower premiums.

- Consider a Defensive Driving Course: Completing a defensive driving course can demonstrate a commitment to safe driving practices. Some insurers offer discounts for completing such courses.

- Maintain Good Grades: Some insurers offer discounts for students who maintain good grades, reflecting a commitment to responsible behavior.

- Choose a Safe Vehicle: Opting for a vehicle with safety features like airbags and anti-lock brakes can lower premiums. Some insurers offer discounts for vehicles with safety ratings.

- Explore Discounts: Insurers offer various discounts, including those for good student records, safe driving courses, multi-car policies, and bundling insurance products.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can lead to lower premiums.

Impact of Driving History and Driving Habits on Rates

A young driver’s driving history and habits play a crucial role in determining their insurance premiums.

- Accidents and Violations: Accidents and traffic violations significantly impact insurance rates. Even a single accident can lead to a substantial increase in premiums.

- Driving Habits: Insurers may use telematics devices or data from smartphones to track driving habits. Factors like speeding, hard braking, and late-night driving can lead to higher premiums.

- Mileage: Drivers who drive fewer miles generally pay lower premiums, as they have a lower risk of being involved in an accident.

Understanding the Impact of Driving History on Rates

Your driving history is a significant factor in determining your Maryland auto insurance rates. Insurance companies use your driving record to assess your risk as a driver, and a history of traffic violations or accidents can lead to higher premiums.

Impact of Traffic Violations

Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, are considered evidence of risky driving behavior. These violations can result in significant increases in your insurance premiums. The severity of the violation and the frequency of occurrences directly impact the premium increase. For example, a first-time speeding ticket may lead to a modest increase, while multiple speeding tickets or more serious violations, like DUI, can lead to substantial rate hikes.

Impact of Accidents

Accidents, regardless of fault, are also a major factor in determining your insurance rates. Insurance companies view accidents as evidence of potential future claims, leading to higher premiums. The severity of the accident, the number of accidents you’ve been involved in, and the time elapsed since the last accident all play a role. A minor fender bender might result in a small premium increase, while a serious accident with injuries could lead to a significant hike.

Challenging Insurance Rate Increases

If you believe your insurance rate increase is unjustified, you can challenge it. You may be able to appeal the increase by providing evidence that you’re a safe driver. This evidence could include a clean driving record, defensive driving courses, and safety features installed in your vehicle. You can also explore other insurance options and compare rates from different providers.

Rebuilding a Positive Driving Record

If you have a poor driving history, you can take steps to rebuild a positive driving record. These steps include:

- Maintaining a clean driving record by avoiding traffic violations.

- Completing defensive driving courses to demonstrate your commitment to safe driving practices.

- Installing safety features in your vehicle, such as anti-theft devices and backup cameras.

- Consider purchasing a car with a good safety rating.

Final Conclusion

Armed with the right information and a proactive approach, Maryland drivers can secure affordable auto insurance without compromising on essential coverage. By understanding the intricacies of the state’s insurance regulations, leveraging available discounts, and actively comparing quotes, you can confidently find the best deal that fits your needs and budget. Remember, a little effort goes a long way in the pursuit of cheap Maryland auto insurance, ultimately saving you money and peace of mind on the road.