The world of employee benefits often leaves individuals grappling with complex choices. One such dilemma arises when employment changes: what happens to your group life insurance? Understanding the crucial differences between life insurance portability and conversion is paramount to ensuring continuous coverage and financial security. This exploration delves into the nuances of each option, empowering you to make informed decisions that align with your evolving needs.

This guide dissects the intricacies of portability and conversion, comparing eligibility criteria, premium structures, coverage extent, and long-term financial implications. We’ll examine how job transitions impact your life insurance, providing practical scenarios to illustrate the best course of action in various circumstances. Ultimately, our aim is to equip you with the knowledge to confidently navigate this critical aspect of your financial planning.

Defining Portability and Conversion in Life Insurance

Life insurance portability and conversion are two distinct options that allow policyholders to maintain coverage even when their employment or circumstances change. While both offer a degree of continuity, they differ significantly in their mechanics and the resulting benefits. Understanding these differences is crucial for policyholders to make informed decisions about their life insurance needs.

Portability and conversion represent alternative approaches to preserving life insurance coverage when a group policy is terminated, such as when an employee changes jobs or retires. The core distinction lies in the transferability of the policy itself versus the ability to exchange it for a new, individual policy.

Life Insurance Portability Explained

Portability refers to the ability to transfer a group life insurance policy to a new employer’s plan without losing coverage or accumulating premiums. This option is typically available only under specific circumstances, often requiring a seamless transition between employers and the existence of a comparable group plan at the new company. The policy’s terms and conditions, including coverage amounts and premium rates, often remain largely unchanged during the transfer. Portability essentially allows for a continuation of the existing group policy without interruption.

Life Insurance Conversion Explained

Conversion, conversely, involves exchanging a group life insurance policy for a new individual policy. This option is generally available upon termination of employment or group coverage, regardless of the reasons for termination. The converted policy will typically have a higher premium than the original group policy, reflecting the increased risk assumed by the insurer. The coverage amount might also be subject to limitations, depending on the terms of the original group plan and the individual insurer’s underwriting guidelines. Conversion provides a new, individual policy rather than a direct continuation of the previous group coverage.

Circumstances for Portability and Conversion

Portability is usually offered when an employee changes employers and both employers offer group life insurance through the same insurer or a participating insurer network. This requires the employee to actively initiate the transfer process within a specified timeframe. Conversion, on the other hand, is typically a right offered to employees upon termination of employment or when the group plan ends, irrespective of the reason. It’s a guaranteed right, although the terms might be less favorable than the original group policy.

Situations Favoring Portability versus Conversion

Consider an employee transferring from Company A to Company B, both of which offer group life insurance through the same insurer. Portability would be the ideal option, ensuring continuous coverage at the same premium rate without any medical underwriting. Conversely, if an employee leaves a company with no group life insurance offered by their next employer, conversion would be necessary to maintain coverage. This might involve a higher premium and potential medical underwriting, depending on the individual insurer’s requirements. Conversion would also be necessary if an employee’s group coverage is terminated due to reasons other than a change of employment, such as a company downsizing. In such instances, conversion ensures continued coverage, albeit possibly at a higher cost.

Eligibility Requirements for Portability and Conversion

Navigating the often-complex world of life insurance requires a clear understanding of policy features like portability and conversion. These options, while offering valuable flexibility, are not universally available and are subject to specific eligibility criteria. Understanding these requirements is crucial for policyholders seeking to maintain coverage during life transitions.

Eligibility for both portability and conversion hinges on several key factors, with significant overlap but also important distinctions. Generally, these features are designed to protect the insured’s coverage during periods of employment change or other significant life events. However, failure to meet specific conditions can result in the loss of these benefits.

Portability Eligibility Requirements

Portability, typically associated with group life insurance policies provided through an employer, allows the insured to maintain coverage even after leaving their job. However, this isn’t automatic. Key eligibility factors often include continuous coverage under the group plan for a specified period (e.g., a minimum of one year), timely application for portability within a defined timeframe (often a 30-60 day window after leaving employment), and the payment of premiums at the individual rate, which is generally higher than the group rate. Failure to meet any of these conditions will usually result in the loss of portability rights. For example, an employee who leaves their job and waits six months before applying for portability may find their application rejected. Similarly, an employee who fails to pay the individual premiums will forfeit their coverage. Common policy types offering portability include group term life insurance plans offered by many large employers.

Conversion Eligibility Requirements

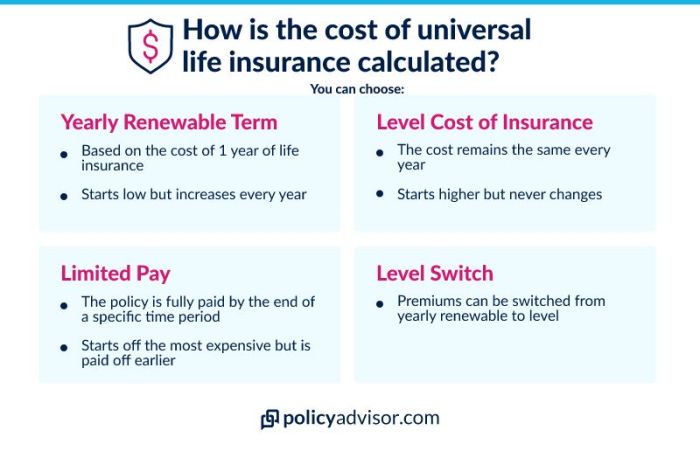

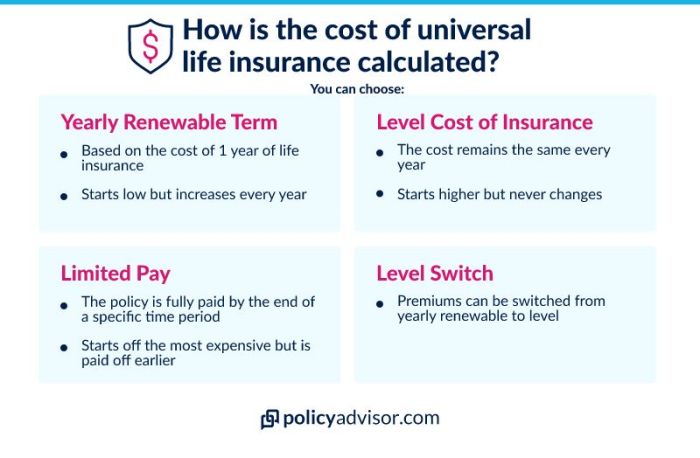

Conversion privileges, also frequently linked to group life insurance, permit the insured to exchange their group coverage for an individual permanent policy without undergoing a new medical examination. This protects individuals from potential health issues that could impact their ability to secure individual insurance later. Eligibility often mirrors that of portability, requiring continuous coverage under the group plan for a specified period. However, conversion differs in that it usually allows for a broader range of permanent life insurance products (whole life, universal life, etc.), offering more flexibility in terms of coverage type and premium payment options. The conversion must typically be exercised within a specific timeframe, and the premiums on the converted policy will be higher than those on the group policy, reflecting the individual risk assessment. A key distinction is that some group plans may only allow conversion to a term policy, limiting the flexibility offered compared to a full conversion to a permanent plan. Term life insurance, often available through group plans, frequently offers conversion privileges.

Factors Leading to Disqualification

Several factors can lead to disqualification from either portability or conversion. These include failure to meet the minimum continuous coverage requirements, exceeding the specified timeframe for application, non-payment of premiums, pre-existing conditions that were not disclosed during the initial enrollment in the group plan (potentially leading to denial of conversion to an individual policy), or the termination of the group plan itself. In some cases, the group insurance policy may explicitly state conditions that negate portability or conversion benefits. Therefore, a careful review of the policy documents is crucial.

Policy Types Commonly Offering Portability or Conversion

Group term life insurance is the most common type of policy offering both portability and conversion options. Many employer-sponsored plans provide this feature as a benefit to employees. However, the specific terms and conditions vary widely depending on the insurer and the employer’s plan design. Some supplemental group life insurance plans might also offer these options. It is essential to consult the specific policy documents for details on eligibility and limitations.

The Impact of Job Changes on Life Insurance Coverage

Job changes frequently disrupt employee benefits, including life insurance. Understanding the portability and conversion options offered by group life insurance plans is crucial for maintaining adequate coverage during these transitions. Failure to do so can leave individuals and their families vulnerable in the event of an unforeseen death.

Job changes significantly affect the availability of life insurance benefits, particularly group life insurance provided by employers. Upon leaving a job, the group life insurance policy typically terminates. However, depending on the policy’s terms, employees may be able to either port their coverage to a new policy or convert their group coverage into an individual policy. The availability and terms of these options vary widely between employers and insurance providers. Ignoring these options can result in a complete loss of life insurance coverage, leaving individuals exposed to considerable financial risk.

Consequences of Losing Group Life Insurance Coverage

Losing group life insurance coverage without portability or conversion options can have severe financial ramifications for surviving dependents. The sudden loss of a primary income earner can create significant financial hardship, particularly if there are outstanding debts, mortgages, or educational expenses. Without life insurance, surviving family members may struggle to maintain their living standards and meet their financial obligations. The lack of a death benefit can exacerbate an already stressful situation, potentially leading to long-term financial instability. This underscores the importance of carefully reviewing the terms of group life insurance policies and exploring available options before leaving a job.

Comparison of Portability and Conversion

The decision between maintaining coverage through portability versus conversion depends on individual circumstances and the specific options offered. Below is a comparison highlighting the benefits and drawbacks of each approach:

| Feature | Portability | Conversion |

|---|---|---|

| Coverage Amount | Often maintains the same coverage amount as the group policy, though this may be subject to underwriting. | Coverage amount may be limited, often dependent on the length of prior group coverage. May require medical underwriting, potentially resulting in reduced coverage or higher premiums. |

| Premiums | Premiums may be lower initially, especially if the employee is healthy and young. | Premiums are typically higher than those for comparable group policies, reflecting the individual risk assessment. |

| Underwriting | May involve a simplified underwriting process, potentially avoiding a full medical examination. | Usually involves a full medical underwriting process, potentially impacting the eligibility and cost of coverage. |

| Flexibility | Offers a seamless transition of coverage without interruption. | Allows for more flexibility in choosing a policy that best suits individual needs, though this comes at the cost of potentially higher premiums and a more complex process. |

Premium Considerations for Portable and Convertible Policies

Choosing between portability and conversion for life insurance significantly impacts premium costs. Understanding the nuances of each option’s premium structure is crucial for making an informed decision that aligns with individual financial goals and risk tolerance. Factors such as age, health status, and the type of policy held all play a significant role in determining the final premium.

Premium structures for portable and convertible policies differ significantly. Portable policies typically involve maintaining the existing premium, or a slightly adjusted premium, when transferring coverage to a new employer’s plan. This assumes the new plan offers a comparable benefit. Conversely, converting a group life insurance policy to an individual policy usually results in a substantially higher premium. This increase reflects the shift from a group risk pool (lower risk, lower premiums) to an individual risk assessment (higher risk, higher premiums).

Age, Health, and Policy Type Influence on Premiums

The age of the insured is a primary driver of premium costs for both portable and convertible policies. Older individuals generally face higher premiums due to increased mortality risk. Health status also plays a critical role. Individuals with pre-existing conditions or health issues will likely experience higher premiums, regardless of whether they opt for portability or conversion. The type of policy – term life, whole life, universal life – further influences premium costs. Whole life policies, for instance, tend to have higher premiums than term life policies because of their cash value component and lifetime coverage.

Scenario Illustrating Cost Differences

Consider Sarah, a 35-year-old with a group term life insurance policy of $500,000 through her employer. Her monthly premium is $50. If her employer offers a portable option, she might see a minimal increase, perhaps to $55, upon changing jobs. However, if she chooses to convert her group policy to an individual policy, her monthly premium could increase dramatically. Considering her age and health, a comparable individual term life policy might cost her $150-$200 per month, a threefold or fourfold increase. This significant difference underscores the importance of carefully evaluating the cost implications before deciding between portability and conversion. This example highlights the substantial financial implications associated with conversion versus portability. The potential savings from maintaining coverage through portability are clearly significant in this scenario.

Coverage Differences

Portable and convertible life insurance policies, while both offering some degree of continued coverage after job loss, differ significantly in the extent and nature of that protection. Understanding these differences is crucial for employees weighing their options when leaving a job with employer-sponsored life insurance. The key distinctions lie in the amount of coverage maintained and the potential for adjustments to policy features.

Portable life insurance typically allows an employee to maintain the same level of coverage they had under their employer’s plan, but often at a higher premium. Convertible policies, conversely, provide the option to switch to a new, often permanent, policy with a different coverage amount and premium structure. However, the converted policy might offer less coverage than the original employer-sponsored plan, especially if the employee’s health has changed. This means the choice between portability and conversion hinges on individual circumstances and risk tolerance.

Coverage Amounts and Premiums

The most significant difference lies in the potential for coverage reduction. Portable policies usually maintain the original death benefit, but the premium will likely increase to reflect the individual’s age and health status outside of the group rate. Convertible policies, on the other hand, might offer a reduced death benefit compared to the original plan. For instance, an employee with a $500,000 employer-sponsored policy might be able to convert it to a $250,000 permanent policy due to underwriting requirements based on their age and health at conversion. The premium for the converted policy will depend on several factors including the new coverage amount, the type of policy (whole life, term life, etc.), and the insurer’s underwriting standards. This scenario highlights the trade-off: maintaining the full death benefit (portability) versus securing some level of permanent coverage at a potentially lower initial premium (conversion).

Benefit Limitations

Certain policy benefits might be affected by the choice between portability and conversion. For example, some employer-sponsored plans include features like accidental death and dismemberment (AD&D) benefits or waiver-of-premium riders. These supplemental benefits might not be fully transferable under a portable policy or might be available only at an additional cost. Conversely, a converted policy may offer different riders or benefits not initially present in the employer-sponsored plan. The specific benefits offered and their availability will depend on the insurer and the terms of both the original and the converted policy. Careful review of policy documents is essential to understand these differences.

Example: Comparing Scenarios

Consider two employees, both with $1 million employer-sponsored term life insurance policies. Employee A chooses portability, maintaining the $1 million death benefit but facing a significantly higher premium. Employee B opts for conversion, securing a $500,000 whole life policy with a lower premium, but with less coverage. Employee A retains higher coverage but pays more; Employee B secures permanent coverage but accepts a lower death benefit. The “best” choice depends on individual financial circumstances and risk tolerance. Both scenarios demonstrate the need for careful evaluation of personal financial needs and risk assessment when selecting between portability and conversion.

The Role of the Insurer in Portability and Conversion Processes

Insurers play a crucial role in facilitating the portability and conversion of life insurance policies, acting as gatekeepers and administrators of these processes. Their involvement spans from initial request processing to final policy issuance or termination. Understanding their procedures and responsibilities is vital for policyholders seeking to maintain or adjust their coverage.

Insurers typically establish standardized procedures for handling portability and conversion requests. These procedures often involve a detailed application process, requiring policyholders to submit documentation verifying their eligibility and the specifics of their desired change. This documentation might include employment verification, health questionnaires, and previous policy details. The insurer then reviews the application, verifying information and assessing any potential risks associated with the portability or conversion. This assessment often includes underwriting considerations, particularly for conversions, where a change in policy type might necessitate a new health evaluation. Once approved, the insurer will issue a new policy reflecting the changes requested, outlining the updated terms and conditions, including premium amounts and coverage details.

Insurer Responsibilities During Portability and Conversion

Insurers are responsible for providing clear and concise information regarding portability and conversion options available under a specific policy. This includes providing detailed explanations of eligibility requirements, the process involved, potential implications for coverage and premiums, and any associated timelines. They must also ensure the accuracy and timeliness of processing requests, adhering to any regulatory requirements and internal guidelines. Furthermore, insurers are obligated to provide transparent communication throughout the process, keeping the insured informed of the status of their request and addressing any queries or concerns promptly. Failure to meet these responsibilities can lead to delays, confusion, and potential legal repercussions.

Policyholder Responsibilities During Portability and Conversion

Policyholders have a crucial role in ensuring a smooth and efficient portability or conversion process. This includes completing the application accurately and completely, providing all necessary documentation within the stipulated timeframe, and promptly responding to any inquiries from the insurer. A failure to provide complete and accurate information can lead to delays or rejection of the request. Policyholders are also responsible for understanding the terms and conditions of both their existing and new policies, ensuring that the changes align with their needs and financial circumstances. Proactive communication with the insurer is key to preventing misunderstandings and resolving any potential issues that may arise during the process.

Challenges and Complications in Portability and Conversion

Several challenges can arise during the portability and conversion process. For example, delays can occur due to incomplete or inaccurate applications, missing documentation, or unforeseen issues during the underwriting review. Changes in health status between the initial policy issuance and the portability or conversion request can impact eligibility and premium rates, potentially resulting in higher premiums or policy rejection. Discrepancies in policy interpretations between the insurer and the policyholder can also lead to disputes. Furthermore, if the original policy is no longer in force due to non-payment or other reasons, portability or conversion may be impossible. In some instances, specific policy clauses or limitations might restrict portability or conversion options, leading to restrictions on the policyholder’s choices. For instance, a policy might only allow portability under specific circumstances, such as a change in employment within the same company group.

Tax Implications of Life Insurance Portability and Conversion

Navigating the tax implications of portable and convertible life insurance policies requires a careful understanding of relevant tax laws and regulations. The tax treatment can vary significantly depending on the specific type of policy, whether portability or conversion is chosen, and the individual’s overall financial circumstances. Failure to account for these implications could lead to unexpected tax liabilities.

Tax laws governing life insurance vary across jurisdictions, but some general principles apply. Generally, the death benefit paid to a beneficiary is usually tax-free, provided it’s paid as a lump sum. However, the tax treatment of premiums paid, cash value accumulation, and any withdrawals or loans taken against the policy’s cash value can be complex and depend on several factors.

Tax Implications of Policy Premiums

Premiums paid for life insurance policies are generally not tax-deductible. This applies regardless of whether the policy is portable or convertible. However, exceptions exist in specific situations, such as when the policy is part of a qualified employee benefit plan. For example, group term life insurance premiums paid by an employer on behalf of an employee are generally not included in the employee’s gross income up to certain limits. These limits are adjusted annually for inflation and are specified by the IRS. Exceeding these limits would result in the employee being taxed on the excess.

Tax Implications of Cash Value Accumulation

Life insurance policies with a cash value component, such as whole life insurance, accumulate cash value over time. This cash value is generally considered a tax-deferred investment. This means that you don’t pay taxes on the growth of the cash value until you withdraw it. However, if you withdraw funds before age 59 1/2, you may be subject to an additional 10% tax penalty, unless certain exceptions apply (such as for qualified medical expenses). Withdrawing funds from a portable or convertible policy doesn’t change the fundamental tax treatment of cash value accumulation; the tax deferral still applies. The tax implications arise only upon withdrawal or distribution.

Tax Implications of Policy Conversions

Converting a group life insurance policy to an individual policy typically doesn’t trigger a taxable event. The conversion itself is generally considered a non-taxable transaction. However, any subsequent withdrawals or loans from the converted individual policy would be subject to the tax rules discussed above. Similarly, the death benefit remains tax-free to the beneficiary. The key is to understand that the conversion process itself is not a taxable event, but subsequent actions involving the converted policy might be.

Tax Implications of Policy Portability

The portability of a group life insurance policy, where the policy is transferred to a new employer, generally doesn’t have direct tax implications. The ownership of the policy changes, but the underlying tax rules remain the same. Premiums remain non-deductible, cash value accumulation continues to be tax-deferred, and the death benefit remains tax-free upon the insured’s death. The critical aspect is that the portability feature itself doesn’t create a new tax liability.

Summary of Key Tax Considerations

The following table summarizes key tax considerations for individuals choosing between portability and conversion of their life insurance policies:

| Feature | Portability | Conversion |

|---|---|---|

| Premiums | Generally not tax-deductible | Generally not tax-deductible |

| Cash Value Accumulation | Tax-deferred growth | Tax-deferred growth |

| Withdrawals/Loans | Subject to income tax and potentially 10% penalty | Subject to income tax and potentially 10% penalty |

| Death Benefit | Tax-free to beneficiary | Tax-free to beneficiary |

| Conversion Process Itself | Not a taxable event | Not a taxable event |

Long-Term Financial Planning and Life Insurance Options

The choice between portable and convertible life insurance significantly impacts long-term financial planning, influencing retirement and estate strategies. Understanding the nuances of each option is crucial for aligning insurance coverage with broader financial goals. Failure to consider these options carefully can lead to inadequate coverage or unnecessary expense in the long run.

The portability versus conversion decision hinges on the anticipated longevity of employment and the individual’s risk tolerance. Portability offers continuity of coverage, while conversion provides flexibility but often at a higher cost. This choice, therefore, interacts directly with retirement planning and estate planning goals, impacting the overall financial security of the insured and their beneficiaries.

Retirement Planning Implications of Portability and Conversion

Choosing portability ensures continued life insurance coverage even after a job change, potentially providing a crucial financial safety net during retirement. This is particularly valuable if the individual anticipates difficulty securing new coverage later in life due to age or health conditions. Conversely, converting a group life insurance policy to an individual policy might result in higher premiums, impacting retirement savings. For instance, a 55-year-old employee with a portable policy maintains continuous coverage, avoiding the potentially higher costs and stricter underwriting associated with obtaining a new individual policy at an older age. However, if that same employee opts for conversion and faces health issues, the resulting individual policy premium might be significantly higher, straining retirement resources.

Estate Planning Considerations for Portable and Convertible Policies

Life insurance plays a vital role in estate planning, providing funds for beneficiaries after death. The portability option offers a seamless transition of coverage, ensuring that the death benefit remains in place regardless of employment changes. This consistent coverage simplifies estate planning, providing a predictable asset for beneficiaries. Conversion, while offering flexibility, introduces uncertainty regarding future premiums and coverage amounts. For example, an individual with a substantial estate might choose portability to maintain a guaranteed death benefit, simplifying estate distribution and minimizing potential disputes among heirs. In contrast, an individual with a smaller estate and a higher risk tolerance might opt for conversion, potentially accepting higher premiums for greater flexibility in adjusting coverage levels over time.

Scenarios Illustrating Long-Term Financial Advantages

Consider two scenarios: First, a young professional with excellent health and a stable career path might prioritize cost-effectiveness and choose portability. The lower premiums associated with portability allow for greater investment in other long-term financial goals like retirement savings. Second, an older professional nearing retirement with pre-existing health conditions might find conversion more beneficial, despite higher premiums, as securing a new individual policy later might prove impossible or prohibitively expensive. This illustrates how individual circumstances and long-term financial goals dictate the optimal choice between portability and conversion. In essence, portability prioritizes continuous coverage and predictable premiums, while conversion offers flexibility at the potential cost of higher premiums.

Illustrative Scenarios Comparing Portability and Conversion

Understanding the practical differences between portability and conversion of life insurance is crucial for making informed decisions. The optimal choice depends heavily on individual circumstances, financial goals, and the specific terms offered by the insurer. The following scenarios illustrate how these options play out in real-world situations.

Scenario 1: Career Change to a Smaller Company Without Group Life Insurance

Imagine Sarah, a 35-year-old marketing executive, who leaves her high-paying job at a Fortune 500 company with a generous group life insurance policy to start her own consulting business. Her employer’s policy offers portability. Conversion, however, is also an option. Choosing portability allows Sarah to maintain her existing coverage level at the same premium, though she’ll need to pay the premiums herself. Conversion, on the other hand, might result in a significantly higher premium for a potentially lower coverage amount, as the new policy would be based on her current health status and age. In this scenario, portability is clearly preferable, preserving her coverage without a substantial cost increase or reduction in benefits. Failing to utilize portability could leave Sarah uninsured or underinsured, jeopardizing her family’s financial security if she were to pass away.

Scenario 2: Retirement and Reduced Income

Consider John, a 60-year-old accountant who is retiring from a company with a convertible group life insurance policy. He has enjoyed a stable income and comprehensive benefits package throughout his career. Now, with a significantly reduced income stream, the high premiums associated with converting his group life insurance policy into an individual policy could create a considerable financial strain. Moreover, his health status might necessitate a higher premium or even policy rejection. In this case, carefully assessing his financial resources and exploring alternative, more affordable life insurance options (such as term life insurance) is crucial. Converting his existing policy might prove financially unsustainable and leave him without adequate coverage during retirement, a potentially devastating outcome for his family.

Scenario 3: Improved Health and Increased Income

Let’s consider Maria, a 40-year-old teacher who recently changed jobs. Her previous employer offered a group life insurance policy with a conversion option. Since changing jobs, Maria has significantly improved her health and received a substantial salary increase. Converting her group policy into an individual policy might be beneficial in this instance. Her improved health could translate to lower premiums, and her higher income allows her to comfortably afford the premiums. In this case, converting her policy might offer a better deal than maintaining a potentially smaller amount of coverage through portability, especially if her new employer’s group life insurance is less comprehensive. Choosing portability in this case might mean foregoing a potentially more advantageous and affordable individual policy tailored to her improved circumstances. This could result in Maria paying more for less coverage than necessary.

Epilogue

Choosing between life insurance portability and conversion hinges on a careful assessment of individual circumstances, financial goals, and health status. While portability offers continuity with your existing policy, conversion allows for a potentially more comprehensive, albeit potentially costlier, independent policy. By understanding the intricacies of each option—from eligibility requirements and premium considerations to coverage limitations and tax implications—you can make a well-informed decision that safeguards your family’s financial future. Remember to consult with a financial advisor to personalize your strategy.