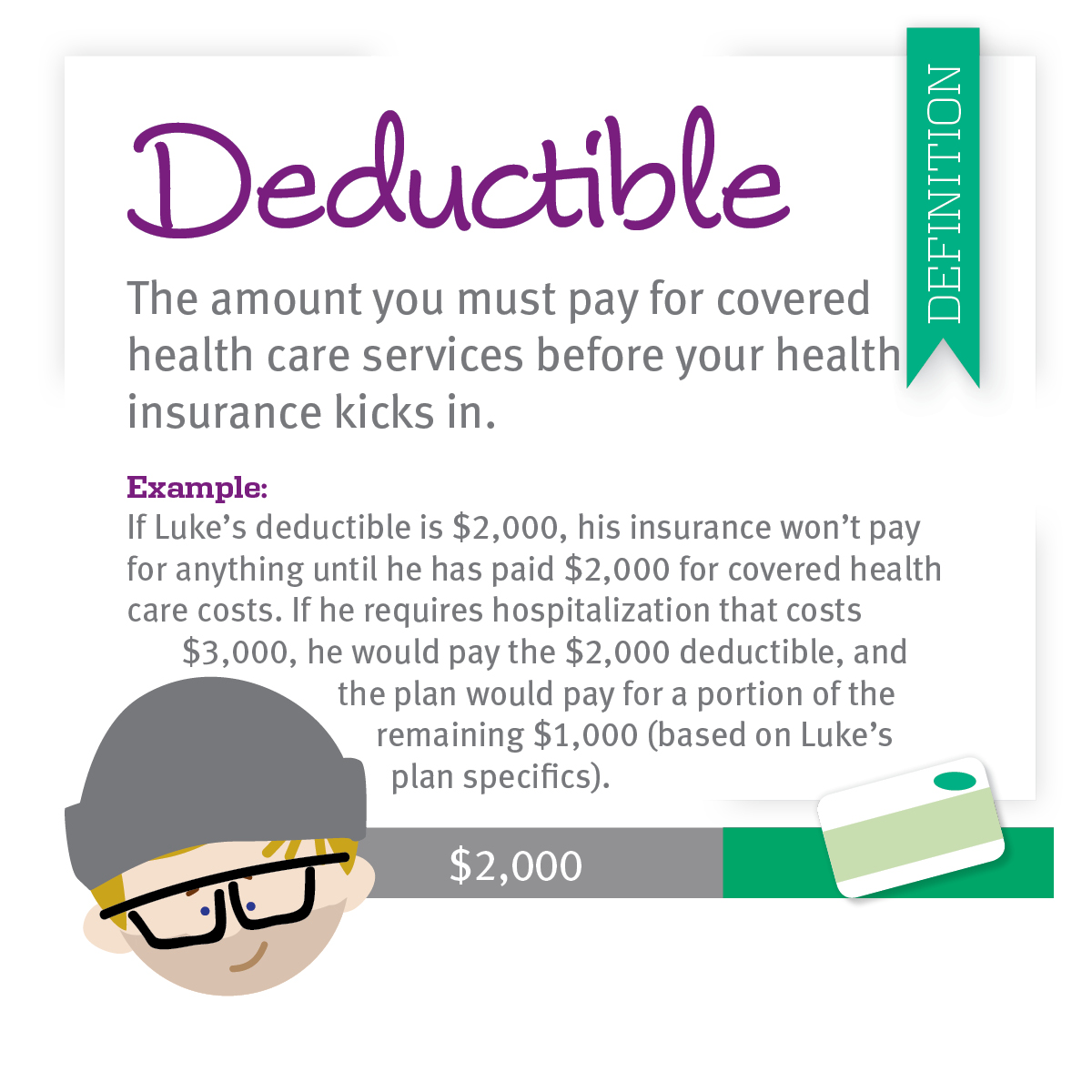

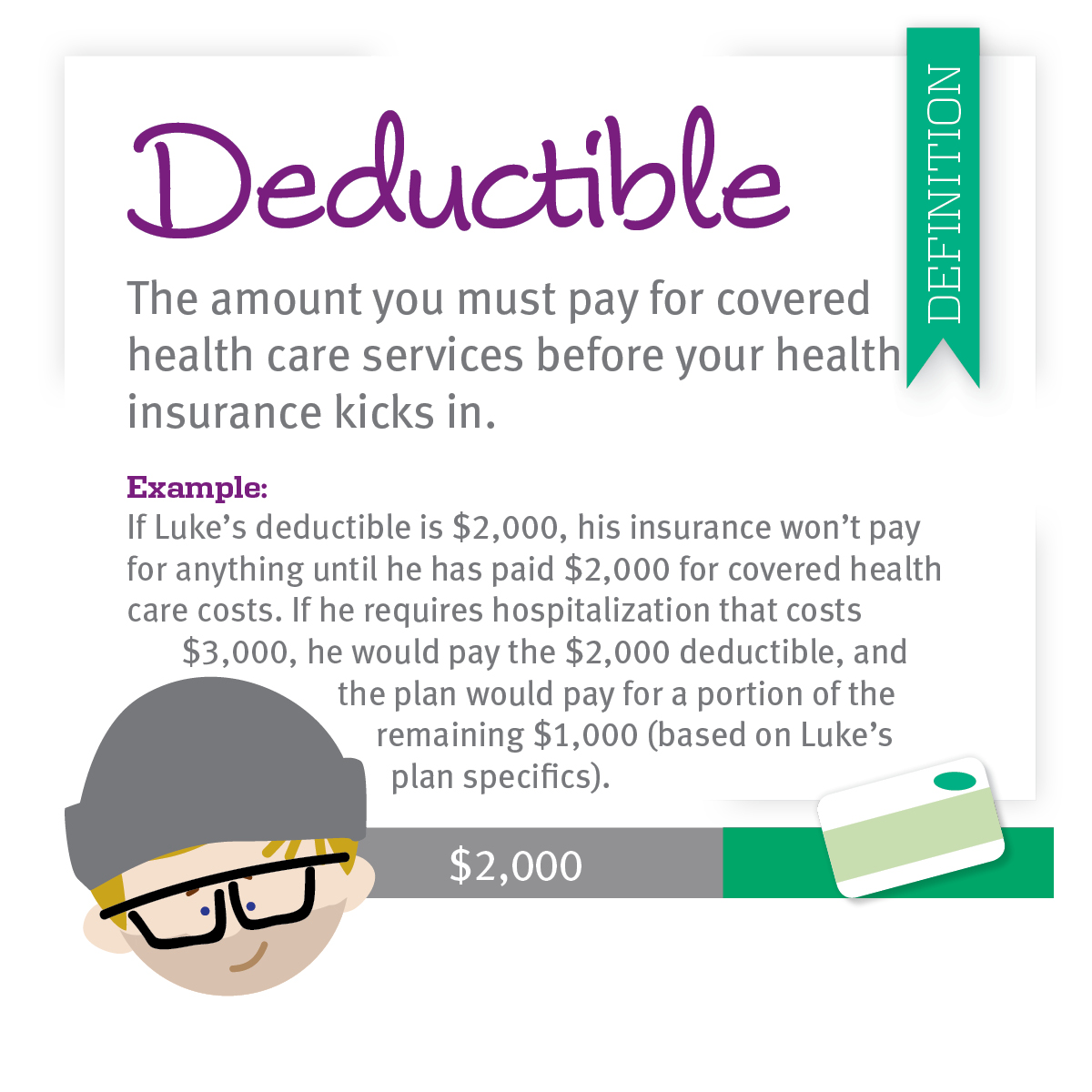

In the intricate world of insurance, understanding the concept of a deductible is paramount. It’s a seemingly simple term, yet its implications can significantly impact your financial well-being. A deductible acts as a threshold you must cross before your insurance policy kicks in, representing the initial portion of a covered loss you’re responsible for paying out of pocket.

This seemingly small detail can have a big impact on your premiums and overall financial planning. By understanding how deductibles function, how they affect claims, and the various types available, you can make informed decisions about your insurance coverage and navigate the complexities of risk management.

Defining Deductible in Insurance

In the realm of insurance, a deductible serves as a crucial element that dictates the financial responsibility shared between the insured and the insurer. It represents a predetermined amount of money that the insured is obligated to pay out-of-pocket before the insurance coverage kicks in.

Deductible as a Risk-Sharing Mechanism

The concept of a deductible functions as a risk-sharing mechanism, effectively distributing the burden of potential losses between the insured and the insurer. It encourages policyholders to exercise prudence and take preventative measures to minimize the likelihood of claims, knowing that they will bear a portion of the cost.

A deductible can be viewed as a self-insurance component, where the insured assumes responsibility for a specified amount of loss.

- Lower Deductibles: A lower deductible translates to a higher premium, as the insurer assumes a greater portion of the risk. This option is suitable for individuals who prioritize comprehensive coverage and prefer to minimize out-of-pocket expenses.

- Higher Deductibles: Conversely, a higher deductible corresponds to a lower premium. This approach appeals to individuals who are comfortable with a larger financial responsibility in exchange for lower insurance costs. They may be confident in their ability to manage smaller losses or prioritize cost savings.

The interplay between deductibles and premiums underscores the fundamental principle of risk sharing in insurance. By adjusting the deductible, individuals can tailor their insurance coverage to align with their risk tolerance and financial circumstances.

Purpose of Deductibles

Deductibles are a fundamental component of insurance policies, serving as a financial threshold that policyholders must meet before their insurer begins covering claims. This seemingly simple concept plays a crucial role in managing risk and ensuring the long-term sustainability of insurance programs.

Deductibles Encourage Responsible Behavior

Deductibles incentivize policyholders to act more cautiously and responsibly, recognizing that they will bear the initial financial burden for smaller claims. This encourages preventive measures and reduces the likelihood of frivolous claims, ultimately benefiting both the policyholder and the insurer.

For instance, a homeowner with a high deductible might be more inclined to take preventive measures to safeguard their property against potential damage, knowing that they will be responsible for a significant portion of the repair costs.

Deductibles Help Control Insurance Premiums

Deductibles are directly linked to insurance premiums, with higher deductibles generally leading to lower premiums. This relationship arises from the fact that insurers are assuming less risk when policyholders agree to shoulder a larger portion of the initial claim costs. By sharing the financial burden, policyholders can access more affordable insurance coverage.

A study by the Insurance Information Institute found that increasing the deductible on auto insurance by $100 can lead to a 5-10% reduction in premiums.

Types of Deductibles

Deductibles in insurance policies can be structured in different ways, each with its own implications for policyholders. Understanding these variations is crucial for making informed decisions about your coverage.

Fixed Deductibles

A fixed deductible is a predetermined amount of money that the insured individual must pay out of pocket before the insurance company starts covering the claim. This amount remains constant regardless of the total cost of the claim. For example, a car insurance policy might have a fixed deductible of $500 for collision damage. If the repair cost is $1,500, the insured person pays the first $500, and the insurance company covers the remaining $1,000.

Percentage-Based Deductibles

In contrast to fixed deductibles, percentage-based deductibles are calculated as a percentage of the total cost of the claim. This means the insured individual’s out-of-pocket expense varies depending on the claim amount. For instance, a health insurance policy might have a percentage-based deductible of 10%. If a medical bill totals $5,000, the insured person would pay the first $500 (10% of $5,000) and the insurance company would cover the remaining $4,500.

Per-Incident Deductibles

A per-incident deductible applies to each separate claim or event. This is the most common type of deductible. For example, if you have a car insurance policy with a $500 per-incident deductible and you are involved in two separate accidents in a year, you would pay a $500 deductible for each accident.

Aggregate Deductibles

An aggregate deductible applies to all claims filed within a specific period, usually a year. This means that the insured individual only needs to pay the deductible once, regardless of the number of claims filed within that period. For instance, a health insurance policy might have an annual aggregate deductible of $1,000. If you have several medical claims totaling $2,000 during the year, you would only pay $1,000 in total deductibles.

Deductibles and Claims

Deductibles are a crucial element in the claims process, influencing how insurance policies function and how policyholders receive compensation. Understanding the role of deductibles is essential for navigating insurance claims effectively.

Deductibles in the Claims Process

Deductibles are the initial amount that the policyholder is responsible for paying out of pocket when filing a claim. This amount is subtracted from the total cost of the claim before the insurance company pays the remaining balance. For instance, if you have a $500 deductible for your car insurance and you file a claim for a $2,000 repair, you would pay $500, and your insurer would cover the remaining $1,500.

Deductibles and Claim Filing

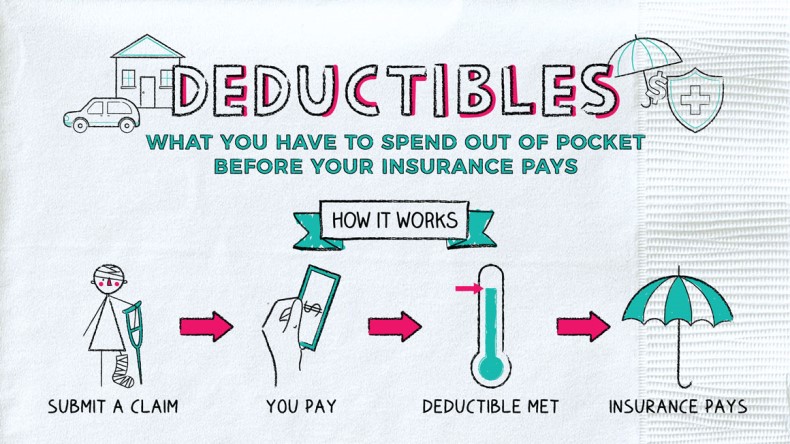

The following steps Artikel how deductibles are applied when filing an insurance claim:

- Incident Occurs: The policyholder experiences an insured event, such as a car accident or a fire.

- Claim Filed: The policyholder contacts their insurance company and files a claim, providing details of the incident.

- Deductible Applied: The insurance company assesses the claim and determines the total cost of repairs or replacement. The policyholder’s deductible is subtracted from this total cost.

- Payment Made: The insurance company pays the remaining balance of the claim, after the deductible is deducted.

Deductibles and Compensation

Deductibles directly impact the amount of compensation received from an insurance claim. The higher the deductible, the less the insurance company pays, and the more the policyholder pays out of pocket. Conversely, a lower deductible means the policyholder pays less upfront, but their premiums are typically higher.

For example, a policyholder with a $1,000 deductible for a car accident will receive $1,000 less in compensation compared to a policyholder with a $500 deductible, assuming the total cost of the claim remains the same.

The choice of deductible depends on the individual’s risk tolerance and financial situation. Those with a higher risk tolerance and a greater ability to absorb costs might opt for a higher deductible to save on premiums. On the other hand, those with a lower risk tolerance and a limited financial buffer may prefer a lower deductible, even if it means paying higher premiums.

Choosing a Deductible

Choosing the right deductible is a crucial part of the insurance process. It involves finding the sweet spot between lower premiums and the cost of paying for smaller claims out of pocket. This decision requires careful consideration of several factors.

Factors to Consider When Selecting a Deductible

The following factors can help you determine the appropriate deductible for your needs:

| Factor | Description |

|---|---|

| Risk Tolerance | Your willingness to shoulder the financial burden of a claim in exchange for lower premiums. Higher risk tolerance suggests a higher deductible is acceptable. |

| Frequency of Claims | Historical claim frequency can guide your deductible choice. Frequent claims may warrant a lower deductible to avoid frequent out-of-pocket expenses. |

| Financial Situation | Your financial stability plays a role. If you can afford a higher deductible without straining your finances, it might be beneficial. |

| Coverage Needs | The type and extent of coverage you require impact the deductible. Higher coverage levels often come with higher deductibles. |

| Premium Costs | The trade-off between a higher deductible and lower premiums should be carefully evaluated. |

Balancing Deductible Costs and Premiums

A higher deductible typically translates to lower premiums. Conversely, a lower deductible means higher premiums. This trade-off requires a careful balance based on your risk tolerance and financial situation.

For instance, if you have a strong financial cushion and rarely file claims, a higher deductible could lead to significant premium savings over time. However, if you have a limited financial buffer and anticipate frequent claims, a lower deductible might be more prudent.

Risk Tolerance and Deductibles

Risk tolerance is a key factor in choosing a deductible. Those with a higher risk tolerance might be comfortable with a higher deductible, knowing they can absorb the cost of smaller claims. Conversely, those with a lower risk tolerance may prefer a lower deductible, even if it means higher premiums.

For example, a young and healthy individual with a stable income might be comfortable with a high deductible for health insurance, as they are less likely to require frequent medical care. On the other hand, an older individual with pre-existing conditions might prefer a lower deductible to minimize out-of-pocket expenses in case of a health emergency.

Deductibles and Coverage Limits

Deductibles and coverage limits are two crucial components of insurance policies that work in tandem to determine the scope of insurance protection. While deductibles represent the amount you pay out-of-pocket before insurance kicks in, coverage limits define the maximum amount your insurer will pay for covered losses. Understanding both concepts is vital for making informed decisions about your insurance needs and ensuring adequate financial protection.

Deductibles and Coverage Limits: A Collaborative Framework

Deductibles and coverage limits work together to create a comprehensive framework for insurance coverage. Deductibles act as a threshold, while coverage limits establish a ceiling. This dynamic duo ensures that you bear a portion of the risk, while the insurer assumes responsibility for the remaining costs within the defined coverage limit.

For example, if you have a $500 deductible on your auto insurance policy with a $100,000 coverage limit, and you get into an accident causing $10,000 in damages, you would pay the first $500 (deductible), and your insurance company would cover the remaining $9,500, but not exceeding the coverage limit of $100,000.

Deductibles in Different Insurance Types

Deductibles are a crucial aspect of insurance policies, influencing both the cost of premiums and the financial responsibility of policyholders during claims. Understanding how deductibles operate in different insurance types is essential for making informed decisions about coverage and cost.

Deductibles in Different Insurance Types

Deductibles vary significantly across different types of insurance, reflecting the nature of the risks covered and the potential costs involved. Here’s a table comparing and contrasting deductibles in common insurance types:

| Insurance Type | Typical Deductible Amounts | Implications |

|—|—|—|

| Health Insurance | $1,000 – $10,000+ | Higher deductibles generally result in lower monthly premiums. However, policyholders are responsible for a larger out-of-pocket expense before coverage kicks in. |

| Auto Insurance | $250 – $1,000 | Deductibles for collision and comprehensive coverage typically range from $250 to $1,000. Higher deductibles lower premiums but increase out-of-pocket costs for repairs or replacements. |

| Homeowners Insurance | $500 – $2,500 | Deductibles for property damage and liability coverage typically range from $500 to $2,500. Higher deductibles can lower premiums but increase out-of-pocket costs for repairs or replacements. |

Deductibles and Specific Insurance Products

Deductibles can also vary within specific insurance products, depending on factors such as coverage options, policy limits, and risk factors. For instance, in health insurance, deductibles may differ based on:

* Plan Type: High-deductible health plans (HDHPs) typically have higher deductibles than traditional plans.

* Coverage Level: Plans with higher coverage limits may have higher deductibles.

* Individual vs. Family Coverage: Family coverage typically has higher deductibles than individual coverage.

Similarly, in auto insurance, deductibles can vary based on:

* Vehicle Type: Luxury or high-performance vehicles may have higher deductibles.

* Age and Driving Record: Drivers with a history of accidents or violations may have higher deductibles.

* Coverage Options: Comprehensive coverage (which covers non-collision damages) often has a higher deductible than collision coverage.

Deductibles and Coverage Limits

It’s important to note that deductibles are distinct from coverage limits. Coverage limits represent the maximum amount the insurer will pay for a covered claim, while deductibles represent the amount the policyholder is responsible for paying before the insurer begins covering costs.

For example: If a homeowner has a $1,000 deductible on their homeowners insurance policy and suffers a $5,000 fire damage claim, they will be responsible for the first $1,000 of the claim, and the insurer will cover the remaining $4,000.

Choosing a deductible that balances affordability and financial protection is a key decision in insurance planning.

Deductibles and Premium Costs

Deductibles and insurance premiums are intricately linked, forming an inverse relationship. In essence, a higher deductible often translates to a lower premium, and vice versa. Understanding this dynamic is crucial for policyholders seeking to balance affordability with coverage.

The Relationship Between Deductibles and Premiums

Insurance premiums represent the cost of coverage. Insurance companies use actuarial data to assess risk and calculate premiums. A higher deductible signifies that the policyholder assumes a greater portion of the financial burden for covered events. Consequently, the insurance company’s potential liability is reduced, allowing them to offer lower premiums.

How Higher Deductibles Can Lower Premiums

A higher deductible means the policyholder is responsible for paying a larger amount out-of-pocket before the insurance coverage kicks in. This reduces the likelihood of the insurance company having to pay out claims, leading to lower costs for them. As a result, they can pass on these savings to policyholders in the form of lower premiums.

Illustrative Examples of Deductible Choices and Premium Costs

Consider two individuals seeking car insurance. Both have identical driving records and vehicle types.

- Individual A opts for a $500 deductible. Their premium might be $100 per month.

- Individual B chooses a $1,000 deductible. Their premium could be $80 per month.

This example illustrates how a higher deductible (Individual B) results in a lower monthly premium. However, it’s important to note that if a claim arises, Individual B will have to pay a larger amount out-of-pocket before insurance coverage applies.

Deductibles and Financial Planning

Deductibles are a critical aspect of insurance policies that can significantly impact your personal finances. By understanding how deductibles work and incorporating them into your financial planning, you can make informed decisions about your insurance coverage and manage your financial risk effectively.

Budgeting for Potential Deductibles

It is crucial to budget for potential deductibles as they represent out-of-pocket expenses you’ll incur before your insurance coverage kicks in.

- Estimate Potential Claims: Consider the likelihood of making claims on your various insurance policies, such as health, auto, or homeowners insurance. For example, if you live in an area prone to natural disasters, you might need to factor in a higher deductible for your homeowners insurance.

- Create a Contingency Fund: Set aside funds specifically for deductibles. This emergency fund can help you cover unexpected expenses without disrupting your financial stability.

- Review Deductibles Regularly: As your financial situation changes, review your deductibles to ensure they align with your risk tolerance and budget. If you can afford a higher deductible, you may qualify for lower premiums.

Deductibles and Consumer Protection

.png/9025a687-d4ba-450f-fa19-12a92c3cb212?imagePreview=1)

Deductibles play a crucial role in consumer protection within the insurance system. By requiring policyholders to share a portion of the risk, deductibles encourage responsible behavior and help maintain the integrity of the insurance system.

Deductibles Encourage Responsible Behavior

Deductibles incentivize policyholders to take precautions to prevent losses. Knowing they will bear a portion of the cost, individuals are more likely to engage in preventative measures, such as securing their homes, driving safely, or maintaining their health. This proactive approach helps to reduce the frequency and severity of claims, ultimately benefiting both the individual and the insurance system.

Deductibles Reduce Fraudulent Claims

The presence of a deductible acts as a deterrent against fraudulent claims. Individuals are less likely to file false claims if they know they will have to pay a portion of the cost themselves. This discourages individuals from exaggerating losses or fabricating claims, ensuring that insurance payouts are made only for legitimate claims.

Deductibles Help Maintain the Integrity of the Insurance System

Deductibles help to ensure the financial stability of the insurance system. By sharing the risk, policyholders contribute to the overall cost of insurance. This shared responsibility helps to prevent premiums from becoming excessively high, ensuring that insurance remains accessible and affordable for everyone.

“Deductibles are a fundamental component of the insurance system, acting as a powerful tool for consumer protection, encouraging responsible behavior, and safeguarding the integrity of the insurance market.”

Deductibles and the Future of Insurance

The role of deductibles in insurance is poised for significant transformation as technology reshapes the industry and consumer expectations evolve. The future of deductibles will be driven by a confluence of factors, including the increasing adoption of artificial intelligence (AI), the growth of data analytics, and the rise of personalized insurance products.

Impact of Technology on Deductibles

The convergence of technology and insurance is creating a new paradigm for deductibles. AI-powered risk assessment tools are revolutionizing how insurers evaluate risk and set premiums. Data analytics is enabling insurers to develop more granular risk profiles, leading to more precise pricing and potentially customized deductibles.

- AI-Powered Risk Assessment: AI algorithms can analyze vast amounts of data to identify patterns and predict future risks. This enables insurers to develop more accurate risk assessments and offer tailored deductibles based on individual risk profiles. For example, insurers could use AI to analyze driving patterns, home security systems, and health data to determine personalized deductibles for auto, home, and health insurance, respectively.

- Data Analytics and Personalized Deductibles: Data analytics allows insurers to leverage real-time data to assess risk and adjust deductibles dynamically. This could lead to personalized deductibles that fluctuate based on individual behavior and external factors. For instance, a driver with a consistently safe driving record could be offered a lower deductible, while a driver who frequently exceeds the speed limit might face a higher deductible.

Deductibles in a Changing Insurance Landscape

The insurance landscape is undergoing a rapid transformation, driven by changing consumer preferences, technological advancements, and the emergence of new business models. Deductibles are likely to play a pivotal role in this evolving landscape.

- Shift Towards Personalized Insurance: The rise of personalized insurance products will likely lead to more customized deductibles tailored to individual needs and risk profiles. Consumers will have greater control over their coverage and deductibles, allowing them to choose options that align with their specific risk tolerance and financial circumstances.

- Emergence of New Insurance Models: The emergence of new insurance models, such as pay-as-you-go insurance and micro-insurance, will likely introduce new approaches to deductibles. These models often involve lower premiums but higher deductibles, offering flexibility and affordability to consumers.

Concluding Remarks

Ultimately, navigating the world of deductibles requires a delicate balancing act. You need to weigh the potential cost of a higher deductible against the lower premiums it offers. The key is to find a balance that aligns with your risk tolerance, financial situation, and the specific coverage you need. Remember, understanding the intricacies of deductibles empowers you to make informed decisions about your insurance and protect your financial future.